Back to Blog

HyperliquidDeFiTrading

What is Hyperliquid and how you can use it as a developer

Welcome to the Hyperliquid Series — Part 1: What Is Hyperliquid and How You Can Build on It.

This series is designed for developers, traders, and curious builders who want to understand why Hyperliquid is redefining on-chain trading, and how you can start building on top of it.

We’ll explore not only what makes Hyperliquid unique from an architectural and technical perspective, but also how its open API and ecosystem enable a new wave of developer-driven innovation in DeFi.

Introduction

For years, traders have had to sacrifice transparency, security, speed, UX, or precision depending on the type of platform they used.

On one side, centralized exchanges (CEXs) were ultra-fast but completely closed.

On the other, decentralized exchanges (DEXs) offered transparency but at the cost of performance and user experience.

On one side, centralized exchanges (CEXs) were ultra-fast but completely closed.

On the other, decentralized exchanges (DEXs) offered transparency but at the cost of performance and user experience.

Hyperliquid changed that balance. It was born with a clear goal: deliver the speed of a CEX with the transparency and on-chain verifiability of a true DEX.

What’s most interesting is that it didn’t come from a major company or a multi-million-dollar fund, but from a small, highly technical team led by Jeff Yan and “Iliensinc”, both from Harvard, with a background in quantitative and high-frequency trading (HFT). That technical DNA explains Hyperliquid’s obsession with performance and precision in every detail of its on-chain architecture. With that mindset, closer to an engineering lab than a marketing startup, Hyperliquid was born: a DEX that redefines what it means to trade truly on-chain.

What Is Hyperliquid and What Makes It Different?

Hyperliquid is a fully on-chain Central Limit Order Book (CLOB) DEX that operates on its own Layer-1 blockchain. It currently captures around 70% of all decentralized derivatives trading volume, moving between $8B and $15B USD daily.

Unlike hybrid models where matching occurs off-chain and then settles on-chain (as in Lighter, dYdX, or Aevo), Hyperliquid executes everything within its own infrastructure, using its HyperBFT consensus protocol to achieve low latency.

This architecture enables these four key pillars that set it apart from other DEXs:

- Ultra-fast execution: capable of processing up to ~100,000 orders per second, with room to scale further.

- Public and verifiable data: every order, position, liquidation, and funding rate is visible and auditable on-chain in real time.

- Truly on-chain: no off-chain matching or external dependencies, everything runs natively on its own L1.

- Efficient and community-driven fees: trading fees range from 0.045% taker / 0.015% maker at the base tier, decreasing with higher volume or HYPE staking. Unlike most protocols where fees go to the team, Hyperliquid directs all fees to its community pools, reinforcing a sustainable and user-owned ecosystem.

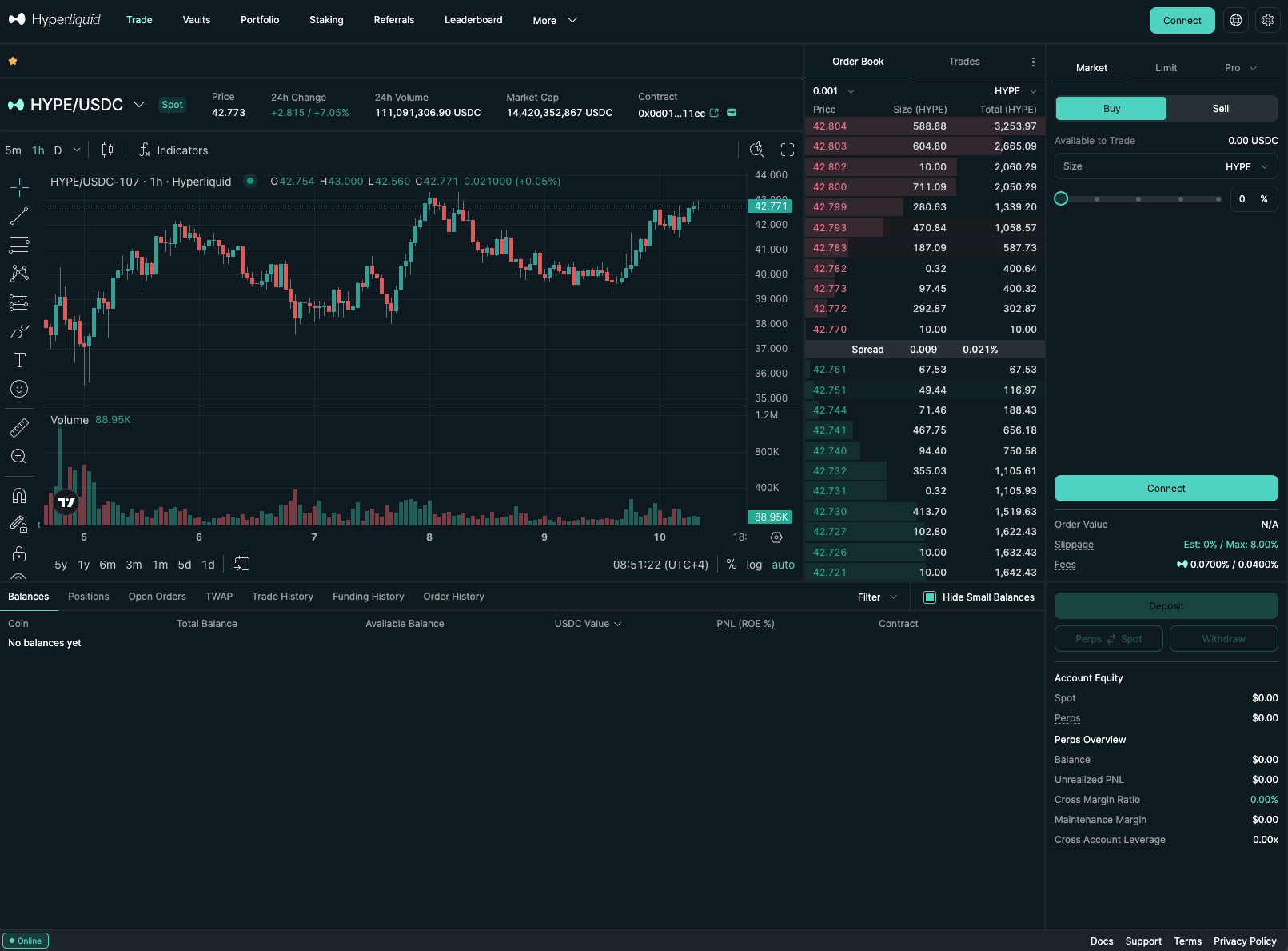

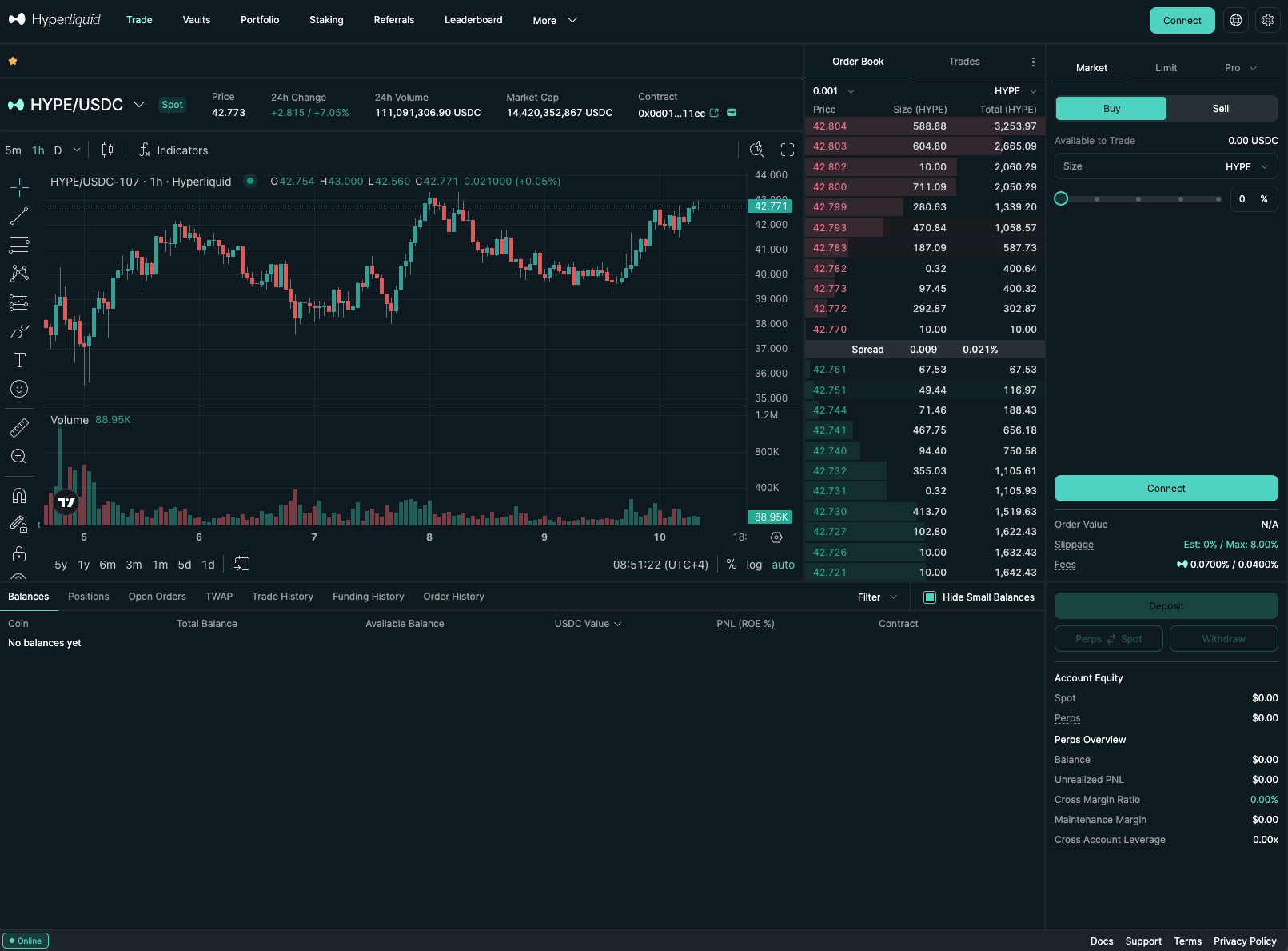

Beyond the technical side, Hyperliquid also provides a web-based trading terminal where users can open positions, monitor live metrics, and view their on-chain PnL and balances. This terminal serves as the visual gateway to the fastest trading engine in DeFi, proving that decentralization doesn’t have to compromise a smooth user experience.

How to Use Hyperliquid as a Developer

It’s important to clarify that Hyperliquid isn’t open-source like Ethereum. However, the protocol follows a philosophy of functional openness: any developer can connect directly through its public API (the same one used by the official frontend) and build tools on top (no permissions, registration, or intermediaries required).

The official documentation is well-structured and stays updated with each protocol version. Hyperliquid also provides a testnet to safely test your integrations before moving to production:

- Testnet base URL: https://api.hyperliquid-testnet.xyz

Note: From my experience, testnet data can sometimes differ significantly from mainnet, so it’s best suited for validating technical flows rather than performance-sensitive systems.

APIs available:

- REST API → deterministic reads (balances, positions, funding rates, full orderbooks, etc.).

- WebSocket API → real-time streams (prices, candles, trades, L2 book, fills, ledger updates, user events, funding, and more).

SDKs & integrations (official/community):

- Python SDK (official, up-to-date)

- Rust SDK (official, currently unmaintained)

- TypeScript SDKs (community)

- CCXT integration (multi-language support)

While it’s possible to interact with the API directly, order signing can feel tricky at first. Hyperliquid’s data structures and signature payloads require careful handling, especially if you implement EIP-712 signing or use custom cryptographic libraries. Doing it manually can be a bit painful at the start, but once you understand the signing and verification flow, it becomes manageable.

Builder Codes and Developer Incentives

Hyperliquid doesn’t just open its API, it actively rewards developers who build on top of it.

Through the Builder Codes, each developer can generate a unique referral code linked to their app and earn fees up to 0.1% on perps and 1% on spot trades.

Note: Builder Codes only apply to fees collected in USDC, meaning they don’t apply to the buying side of spot markets.

To activate a Builder Code, developers must hold at least 100 USDC in their perps account value, a small requirement that ensures only active participants can issue referral integrations.

This approach transforms developers from simple users into true stakeholders of the protocol.

By aligning financial and creative incentives, Hyperliquid cultivates an ecosystem where builders are motivated to launch new tools, dashboards, and trading experiences that push the network forward.

What You Can Build with Hyperliquid

Now that we understand how Hyperliquid works, what makes it unique, and its potential, let’s get to the fun part: what can you actually build on top of it?

🤖 Trading Bots with Custom or Copy-Trading Strategies

Build scalping, market-making, or copy-trading bots that operate fully on-chain, managing your own funds without intermediaries or paid APIs. You can go from private scripts to full trading interfaces, or even Telegram bots that execute orders and push live trade notifications.

📊 Analytical Dashboards or Alert Systems

Design dashboards that display balances, PnL, prices, or risk metrics in real time, and trigger alerts based on your own trading conditions. Perfect for traders or teams who want to monitor performance closely, detect opportunities, or receive automated notifications about key market events.

📈 Market Terminals and Data Platforms

Build your own market data aggregator, price comparison tool, or analytics terminal tracking global activity on Hyperliquid. Using its public feeds (prices, volumes, funding rates, and on-chain metrics), you can create visualizations, market health dashboards, or live stats for the entire community.

🦀 SDKs and Libraries (Rust, TypeScript, Python)

Develop SDKs that abstract WebSocket handling, local caching, or order-signing logic. The Hyperliquid ecosystem is still young and there’s plenty of room to improve developer experience (DX). Whether it’s Rust libraries for low-latency backends, TypeScript for frontends, or Python for research bots, open-source tooling is one of the best ways to contribute real value to the ecosystem.

🛡️ Lending Protocols or Instant Liquidations

Create credit, margin-trading, or liquidation mechanisms that interact directly with Hyperliquid’s on-chain state. This enables ultra-precise liquidation systems where decisions and prices remain perfectly synchronized without relying on oracles or suffering delays between read and execution.

Final Thoughts

Hyperliquid isn’t just a decentralized exchange, it’s a foundation you can build on. If you’re a developer, now is the time to explore this new landscape and leave your mark. Build tools, dashboards, bots, or entirely new experiences on top of an architecture that redefines what on-chain trading means.

And if you were waiting for a sign to start building on Hyperliquid, this article is your sign.

Thinking of building on Hyperliquid or launching a DeFi project?

Zealynx specializes in smart contract audits and blockchain security assessments. If you want to make sure your integration is secure and future-proof, reach out for a friendly chat or connect on Twitter with us @sudosuberenu and @TheBlockChainer.

FAQ: Key Concepts

1. What is a CLOB (Central Limit Order Book)?

It’s the traditional market model used by centralized exchanges: a book that matches buy and sell orders based on price and time. In Hyperliquid, this system is fully on-chain, meaning every order and trade is transparently recorded on the blockchain.

2. What’s the difference between a CLOB DEX and an AMM?

A CLOB DEX (like Hyperliquid) uses a traditional order book, while an AMM (like Uniswap) uses mathematical formulas to set prices based on available liquidity. CLOBs provide higher precision and lower slippage (especially for derivatives) while AMMs are simpler but less efficient for high-frequency assets.

3. What is a Matching Engine?

It’s the core system that pairs buy and sell orders within an exchange. In Hyperliquid, this engine is built directly into the blockchain itself, ensuring all trades occur under the same consensus with no external servers or latency.

4. What’s the difference between a CEX and a DEX?

In a CEX, data, custody, and order matching happen on private servers. In a DEX, all operations take place on the blockchain, allowing users to retain custody of their funds and publicly audit every trade. (It’s worth noting some DEXs still rely partially on off-chain matching.)

5. How do transaction fees work on Hyperliquid, and are there ways to reduce them?

Transaction fees on Hyperliquid depend on your 14-day rolling trading volume and your HYPE staking tier.

Maker and taker fees start at 0.015% / 0.045% for perps and 0.04% / 0.07% for spot, decreasing progressively as your volume grows (in some cases even reaching 0% maker fees).

You can further reduce fees by staking HYPE (up to 40% discount) or trading assets within aligned quote pairs (still in progress).

6. Can I deploy smart contracts or custom protocols directly on Hyperliquid’s blockchain?

Yes, through HyperEVM, Hyperliquid’s native Ethereum-compatible execution layer.

It allows developers to deploy ERC20 contract directly on Hyperliquid’s L1, while maintaining full composability with the exchange’s on-chain state.

Glossary

| Term | Definition |

|---|---|

| CLOB | Central Limit Order Book matching buy and sell orders by price-time priority enabling traditional exchange trading mechanics on-chain. |

| Matching Engine | Core system pairing buy and sell orders within exchange ensuring trades execute under consensus without external servers or latency. |

| Maker/Taker Fee | Fee structure where makers add liquidity to order book paying lower fees while takers remove liquidity paying higher fees. |

| EIP-712 | Ethereum standard for structured data hashing and signing enabling human-readable transaction signatures with domain separation. |

| Funding Rate | Periodic payment between long and short positions in perpetual contracts anchoring derivative prices to underlying spot markets. |

| Perpetual Futures | Derivative contracts without expiration dates allowing indefinite leveraged positions settled through funding rate mechanisms. |

| Mark Price | Fair value reference price calculated from spot markets used for unrealized PnL and liquidation calculations preventing manipulation. |