Back to Blog

RWADeFi

Real World Asset (RWA) Tokenization: Architecture & Security

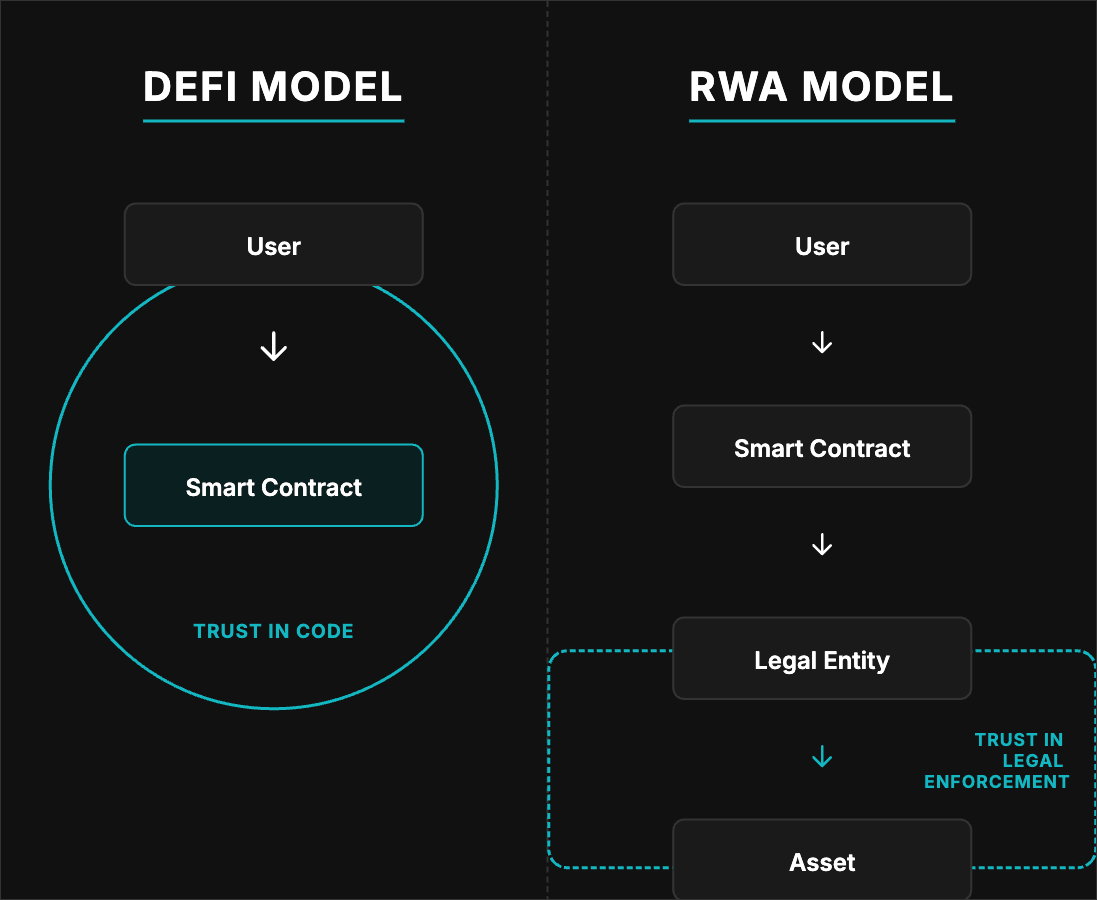

In standard DeFi development, the Ethereum Virtual Machine (EVM) operates as a closed-loop, deterministic state machine. If you own 1 ETH, you own it because the ledger says so. Settlement is atomic: a transaction either succeeds or fails within a single block.

Real World Assets (RWAs)—like real estate, treasury bills, or private credit—break this paradigm. They introduce a profound synchronization problem. The legal world is probabilistic and slow (T+2 settlement days, courts, title registries), while the blockchain is instant.

If a developer treats a tokenized building like a standard ERC-20 token, they risk a fundamental system collapse. For instance, if a private key holding a real estate token is stolen, the blockchain says the thief owns the asset, but the legal system says the victim does. If your smart contract cannot reconcile these diverging states, the token becomes worthless.

The challenge for engineers is not just managing digital scarcity, but architecting a bridge between Code as Law and Code as the Execution Layer for Law.

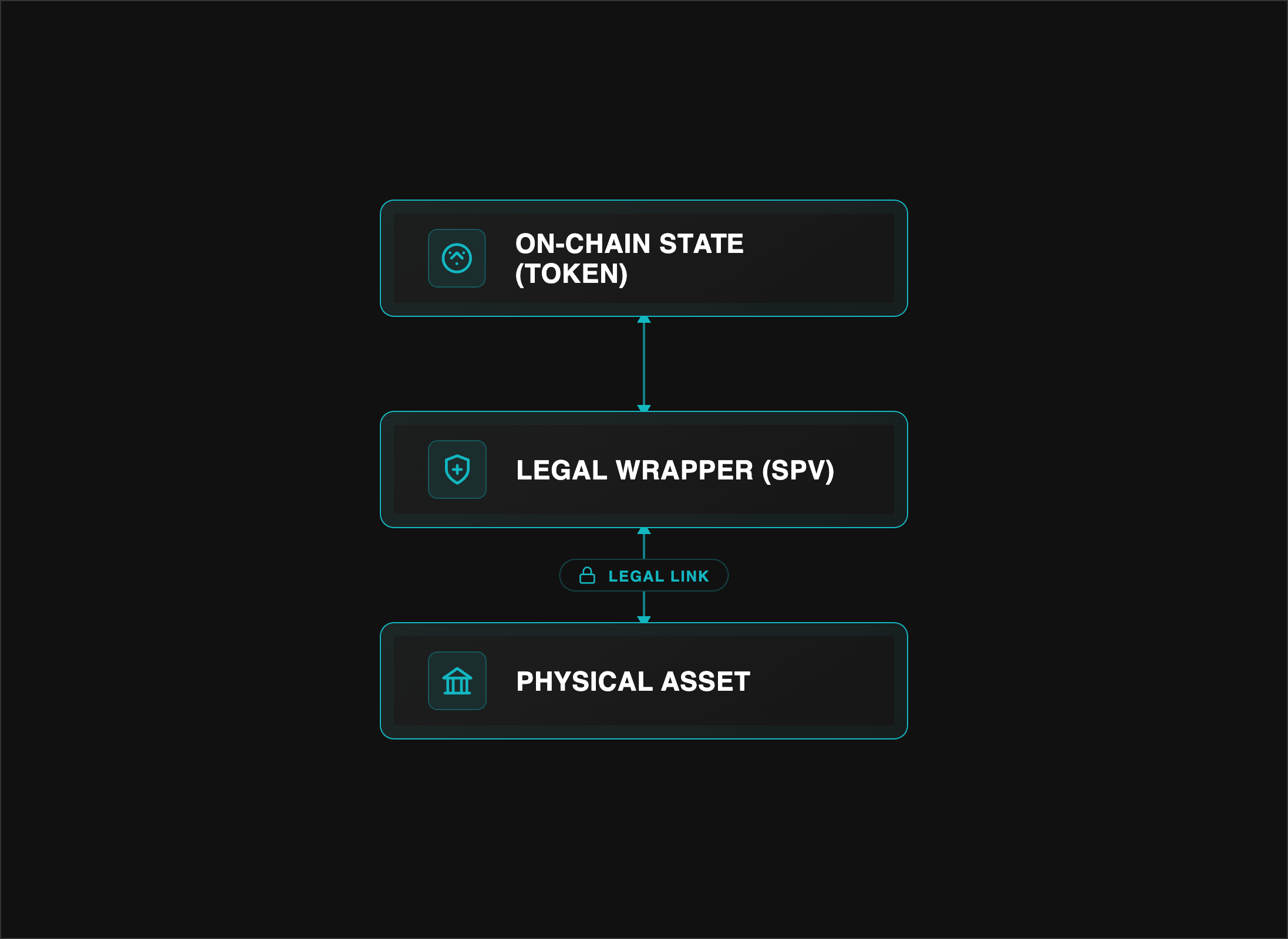

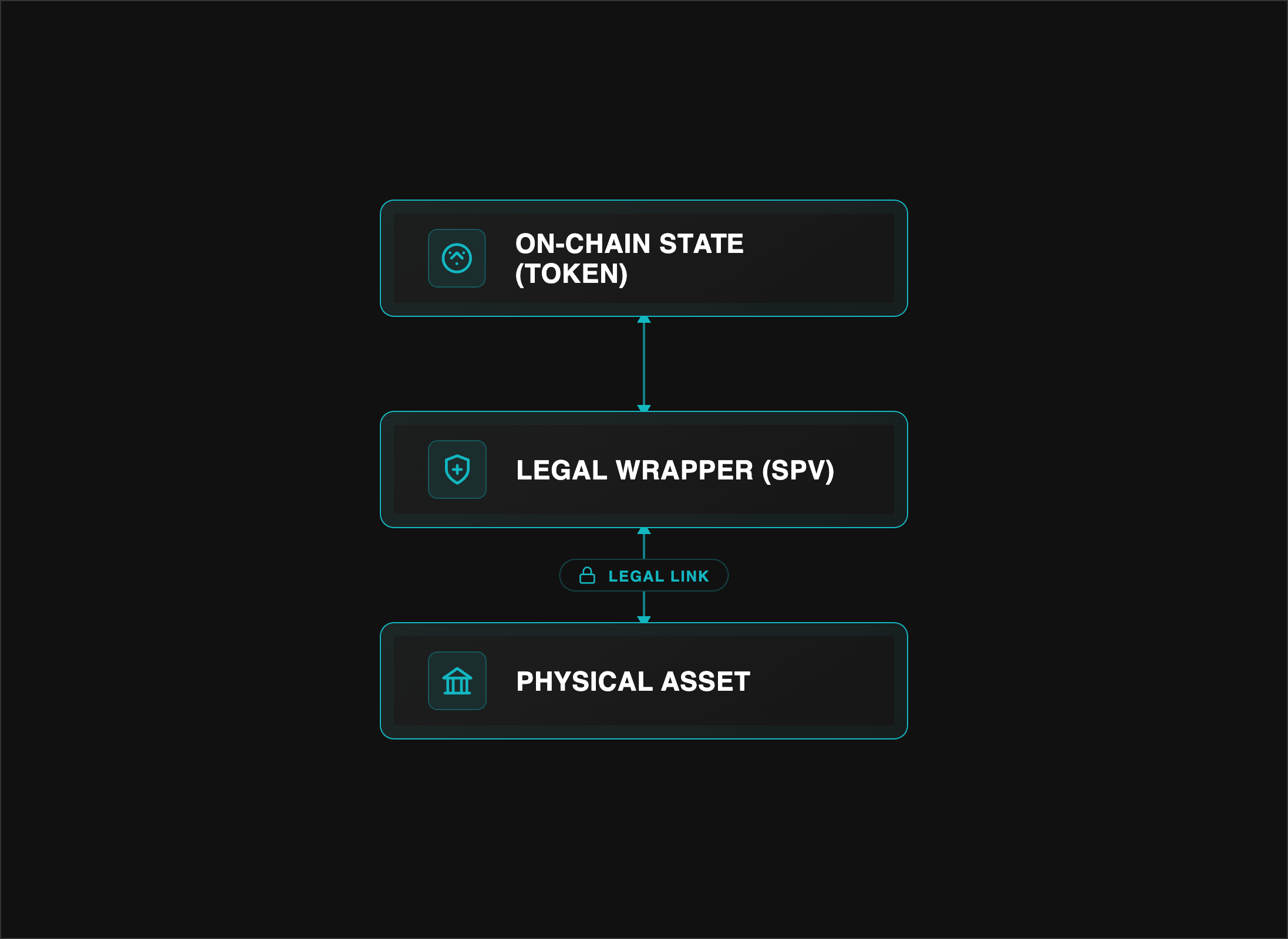

The core concept: The tripartite architecture

An RWA token is effectively a "Digital Twin." It is a programmable claim on a legal entity that holds the physical asset. Secure RWA architecture requires three distinct layers working in lockstep:

- Off-Chain Asset: The physical collateral (e.g., a commercial building).

- Legal Wrapper (SPV): A Special Purpose Vehicle. This is a bankruptcy-remote legal entity that holds only the asset. The token represents shares or debt in this SPV.

- On-Chain Representation: The smart contract managing ownership and transfer logic.

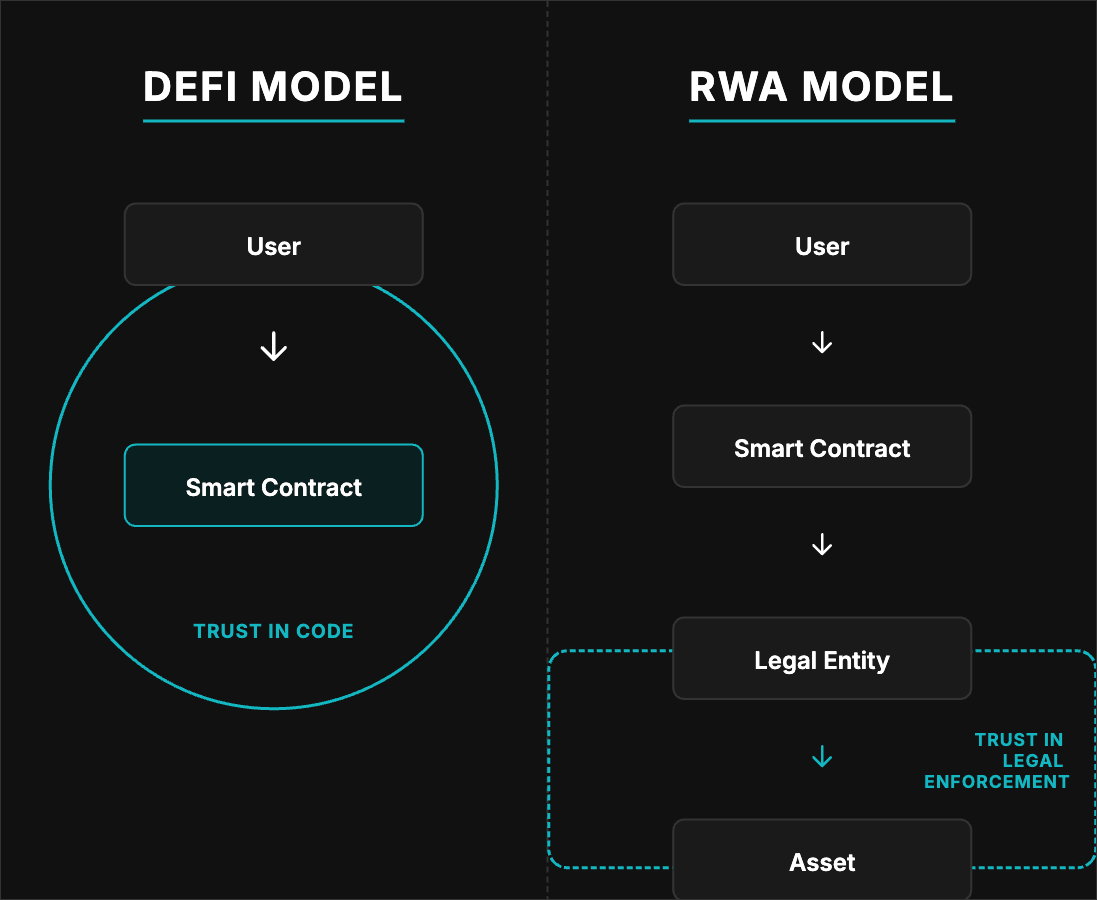

The "trust boundary" shift

In crypto-native protocols (like Uniswap), the trust boundary is the code. In RWAs, the trust boundary shifts to the legal link between the SPV and the Token. If the SPV manager sells the building and runs away with the fiat, the most secure Solidity code in the world cannot recover the value. Therefore, RWA architecture focuses heavily on enforcement and verification.

Implementation: beyond the ERC-20 standard

Standard ERC-20 tokens are permissionless. This is a feature for crypto, but a bug for regulated assets involving KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. RWA development relies on Permissioned Token Standards.

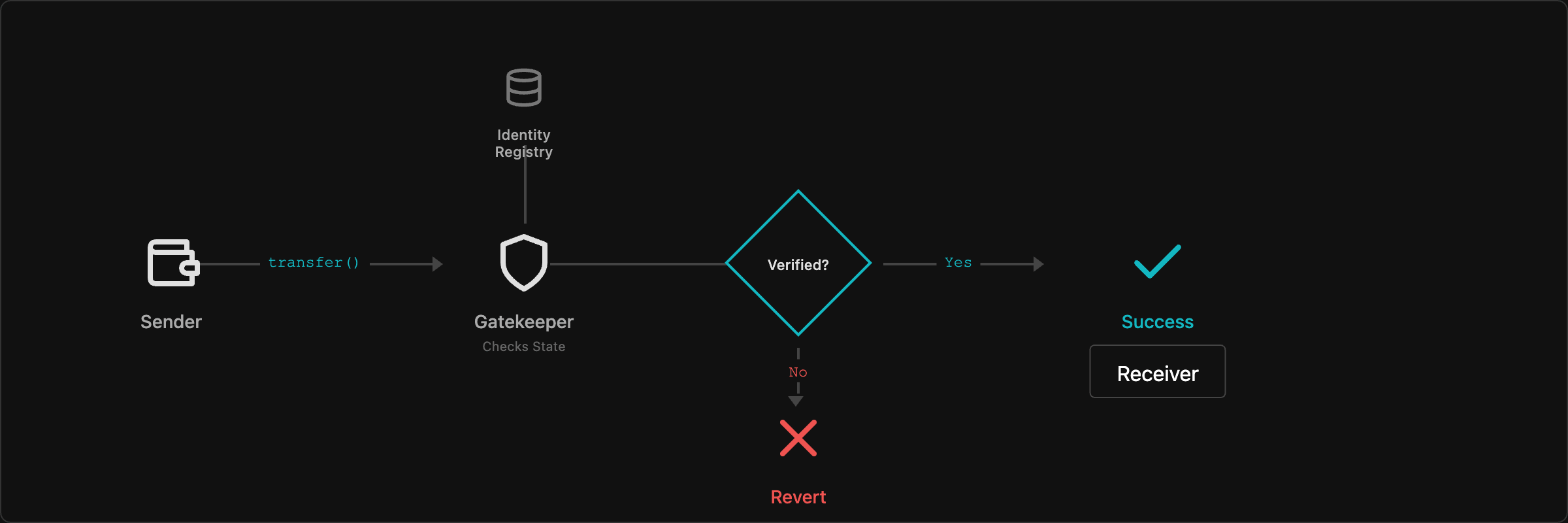

1. ERC-3643 (the identity-centric standard)

Formerly T-REX, this is the industry standard for institutional RWAs. Unlike ERC-20, which maps Address -> Balance, ERC-3643 maps Address -> Identity -> Eligibility.

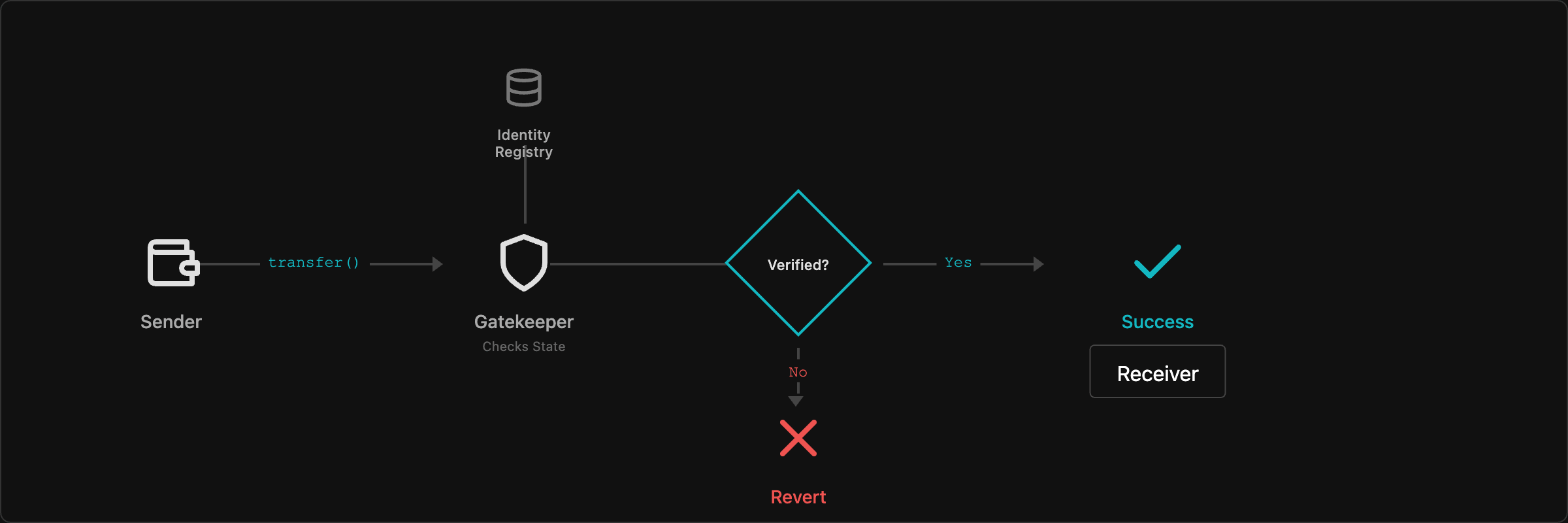

The transfer hook logic:

The token contract overrides the transfer function to check an on-chain Identity Registry before moving funds.

1// Simplified Logic of ERC-36432function transfer(address to, uint256 amount) public override returns (bool) {3 // 1. Identity Check: Is the receiver KYC verified?4 require(_identityRegistry.isVerified(to), "Receiver not verified");56 // 2. Compliance Check: Does this breach limits (e.g., max 500 US investors)?7 require(_compliance.canTransfer(msg.sender, to, amount), "Compliance violation");89 // 3. Execution: Standard storage update10 _transfer(msg.sender, to, amount);1112 return true;13}

Why this matters: If a hacker steals a private key, they cannot transfer the tokens to their own unverified wallet. The asset is effectively "soulbound" to the regulatory whitelist.

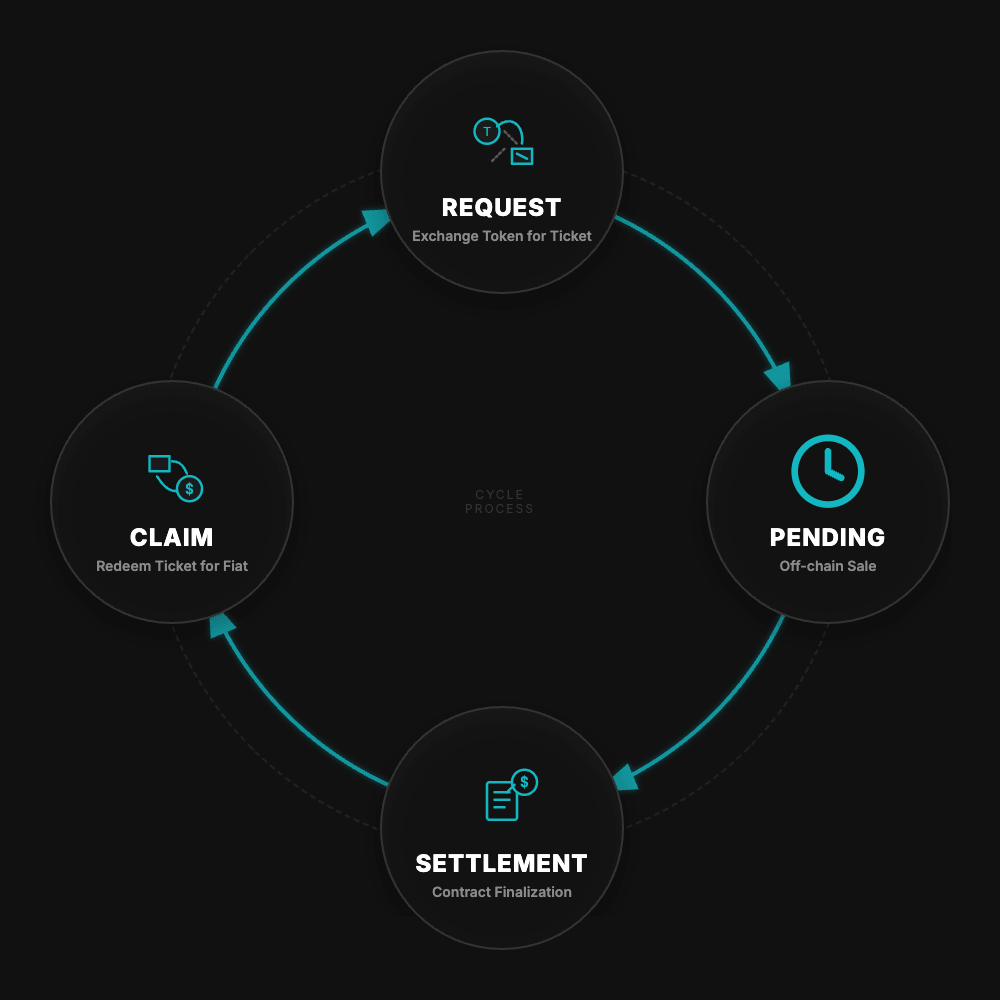

2. ERC-7540 (the asynchronous vault)

A major architectural failure in early RWAs was the "Cash Drag" or "Bank Run" scenario (e.g., the Tangible USDR collapse). Real estate cannot be sold in 12 seconds to satisfy a user's redemption request.

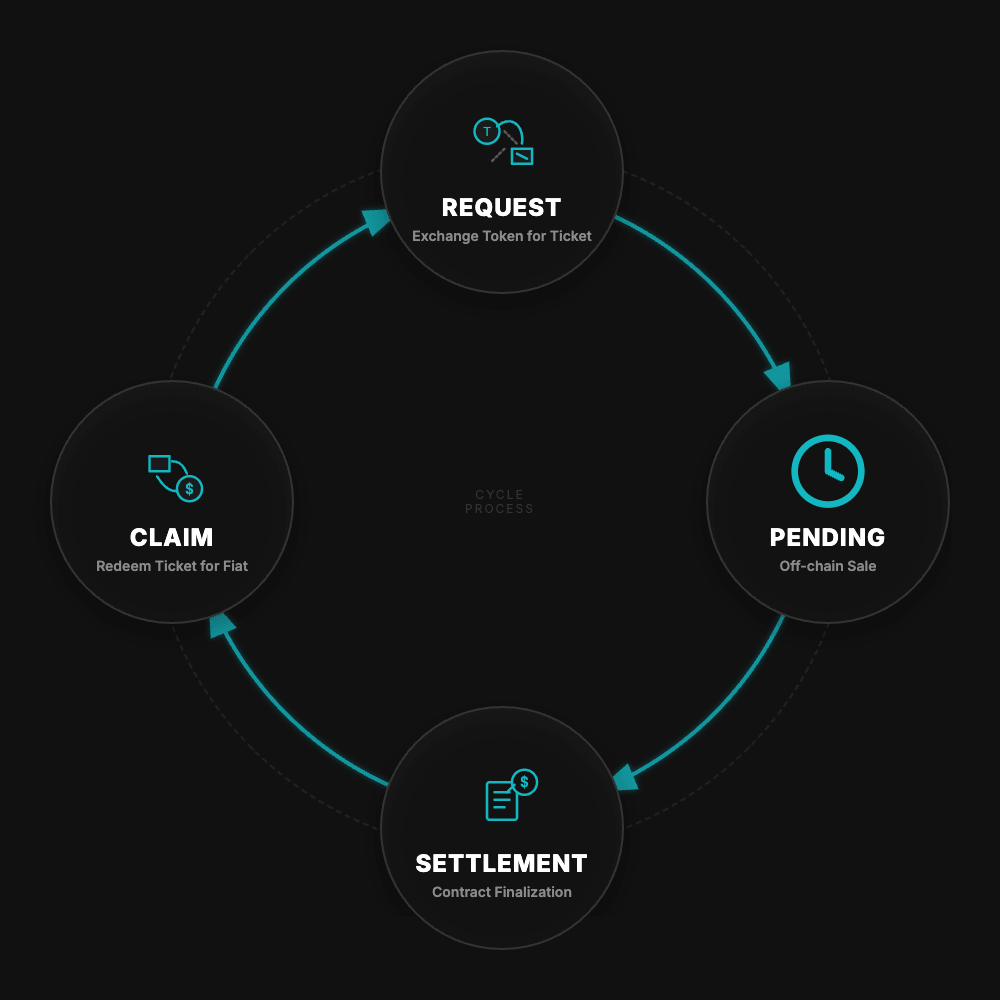

ERC-7540 extends the ERC-4626 Vault standard to handle asynchronous flows:

- Request: User calls

requestRedeem. The contract burns tokens but does not send fiat. It issues a requestId. - Pending: The SPV manager sells the asset off-chain (taking days/weeks).

- Settlement: Once funds arrive, the manager calls

deposit. - Claim: The user calls

claimRedeemto pull their funds.

This decouples the "intent" from the "settlement," preventing liquidity crises where the protocol promises instant liquidity on illiquid assets.

Security & architecture patterns

The "forced transfer" safety net

In decentralization purism, "admin keys" are a vulnerability. In RWAs, they are a requirement. If a user loses their private key, or a court orders an asset seizure, the issuer must be able to recover the tokens.

Implementation: An

AGENT_ROLE or recoveryAgent function allows the issuer to burn tokens from a target address and re-mint them to a new address.Risk mitigation: This power should never sit on a single hot wallet. It requires a Multi-Sig Gnosis Safe or a TimelockController to ensure no single bad actor can seize assets arbitrarily.

Proof of reserve (PoR)

To prevent the SPV from minting more tokens than assets held (fractional reserve fraud), smart contracts should integrate Chainlink Proof of Reserve feeds.

Secure minting pattern:

1function mint(uint256 amount) external onlyRole(MINTER_ROLE) {2 // Fetch latest reserves from Oracle3 int256 provedReserves = poRFeed.latestAnswer();4 uint256 currentSupply = totalSupply();56 // Invariant Check: Supply can never exceed physical reserves7 require(currentSupply + amount <= uint256(provedReserves), "Mint exceeds reserves");89 _mint(msg.sender, amount);10}

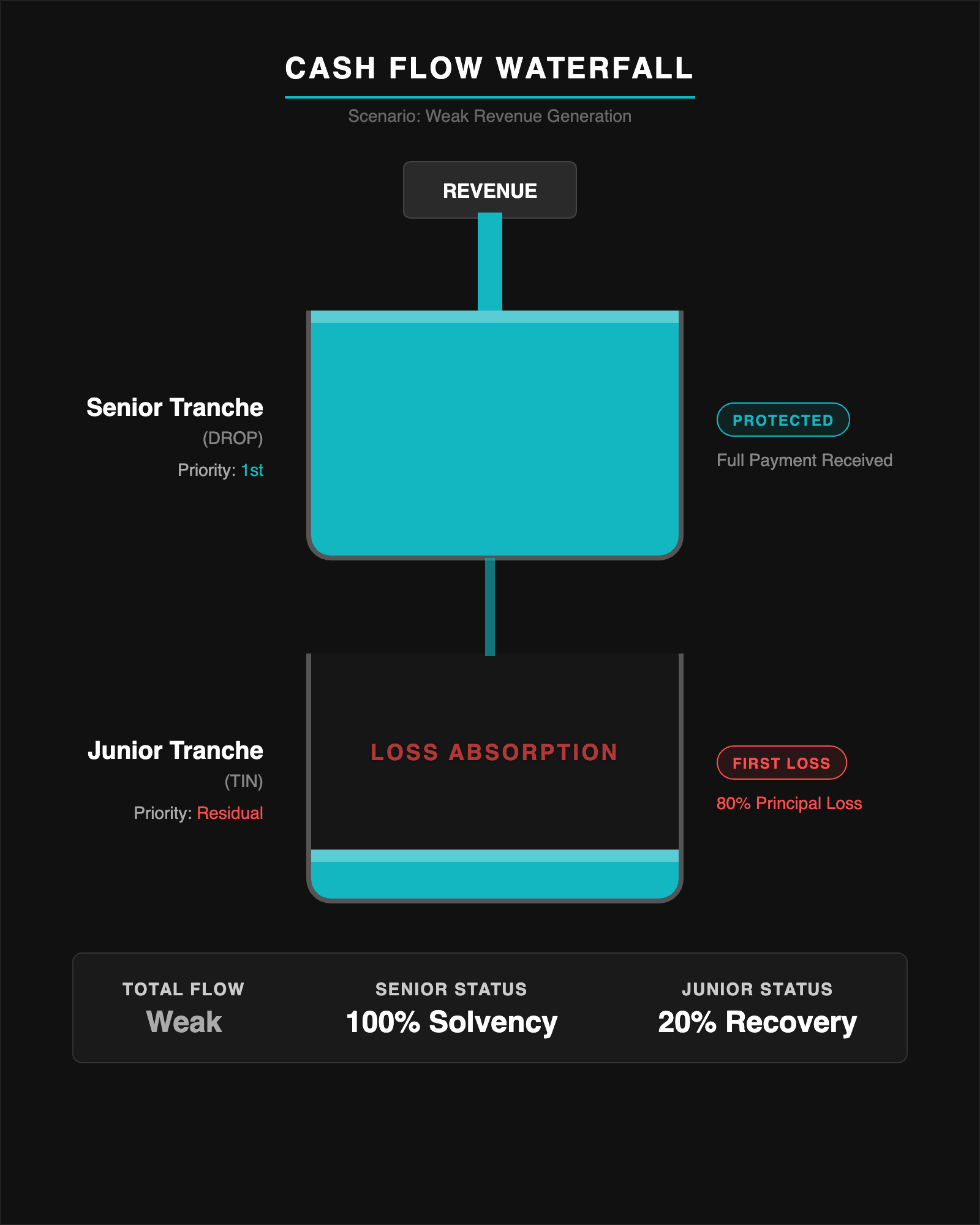

The tranche waterfall (Centrifuge model)

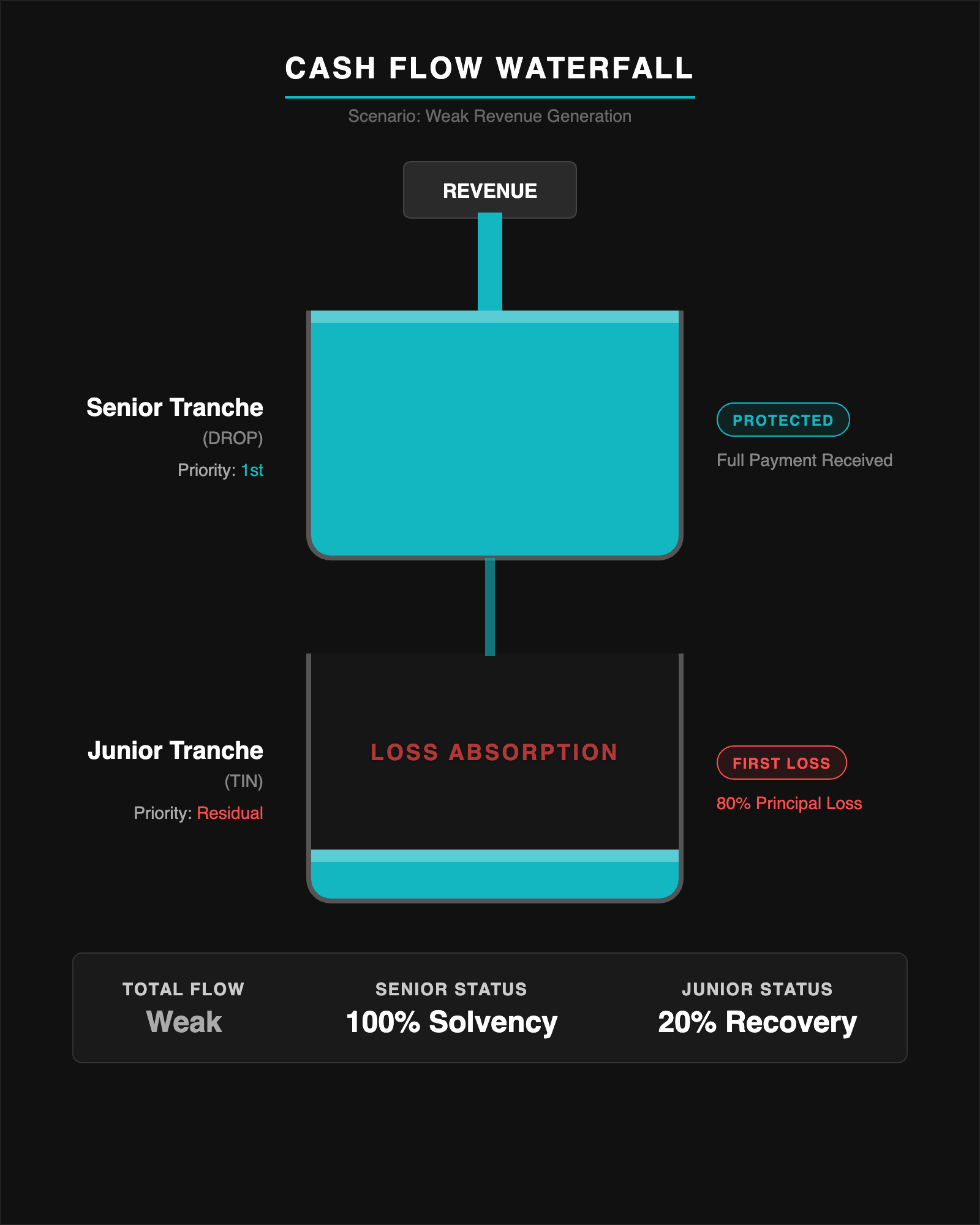

For private credit (e.g., invoice factoring), risks are not uniform. You should implement a "Waterfall" structure using two tokens:

- Senior Token (DROP): Lower yield, first to get paid, last to lose money.

- Junior Token (TIN): Higher yield, absorbs the first defaults.

Solidity logic:

You must calculate Net Asset Value (NAV) using fixed-point arithmetic (Solidity doesn't handle decimals natively). If NAV < Total Liabilities, the Junior token value is written down to zero before the Senior token loses a cent.

Why it matters

Implementing these architectures correctly offers specific technical advantages over traditional finance rails:

- Atomic compliance: Compliance is no longer a post-trade audit process; it is a pre-trade blocking condition embedded in the bytecode.

- Transparency: Proof of Reserve allows investors to verify solvency in real-time, rather than waiting for quarterly PDF reports.

- Composability: Once wrapped in a compliant standard (like ERC-3643), a U.S. Treasury Bill can be used as collateral in DeFi protocols, provided the receiving protocol respects the identity checks.

Conclusion & next step

RWA tokenization is not about jamming real estate onto a blockchain; it is about building a synchronized state machine that respects the latency and legality of the physical world. Your role as a developer is to ensure that the on-chain state can never validly diverge from the off-chain reality.

Get in touch

At Zealynx, we understand that tokenizing real world assets requires more than just Solidity—it requires a robust architecture that bridges the gap between legal frameworks and blockchain state. Whether you are building an RWA platform, implementing ERC-3643 for compliance, or auditing a tokenized asset infrastructure, our team is ready to assist — reach out.

Want to stay ahead with more in-depth analyses like this? Subscribe to our newsletter and ensure you don’t miss out on future insights.

FAQ: RWA architectural foundations

1. What is the "synchronization problem" in RWAs?

It describes the risk where the on-chain state (who owns the token) diverges from the off-chain legal reality (who sits on the title deed). Because legal settlement is slow (T+2) and probabilistic (courts), while blockchain is instant and deterministic, architects must build mechanisms (like legal wrappers and pause functionality) to reconcile these states if they conflict.

2. Why are permissioned standards like ERC-3643 necessary?

Standard ERC-20 tokens are permissionless, meaning anyone can transfer them to anyone. Regulated assets like real estate require strict compliance (KYC/AML). ERC-3643 uses an on-chain Identity Registry to block transfers to unverified wallets at the protocol level, ensuring the asset remains compliant "atomically" without manual oversight.

3. How does ERC-7540 solve the "cash drag" issue?

In illiquid RWAs (like real estate), assets cannot be sold instantly to satisfy redemption requests. ERC-7540 handles this asynchronously: users submit a redemption request, the issuer sells the asset off-chain (which takes time), and once funds settle, the user claims them. This decouples the "intent to sell" from the "settlement," preventing liquidity crises in the protocol.

4. What is the role of the SPV in RWA architecture?

The Special Purpose Vehicle (SPV) is a bankruptcy-remote legal entity established solely to hold the physical asset. The on-chain token represents a share or debt claim against this specific SPV. This structure isolates the asset's risk from the issuer's other liabilities and provides the legal "hook" for the digital token.

Glossary

| Term | Definition |

|---|---|

| Real World Asset (RWA) | Physical or traditional financial assets tokenized on blockchain. |

| Special Purpose Vehicle (SPV) | Bankruptcy-remote legal entity created solely to hold a specific asset. |

| ERC-3643 | Token standard for permissioned securities with identity verification. |

| Oracle | Service providing external data like prices and reserve proofs to contracts. |

| Role-Based Access | Granular permission system assigning roles to addresses. |