Back to Blog

SolidityWeb3 SecurityRWADeFi

Tokenizing Intellectual Property on EVM: Solidity Patterns for Programmable IP Rights

February 13, 2026

9 min

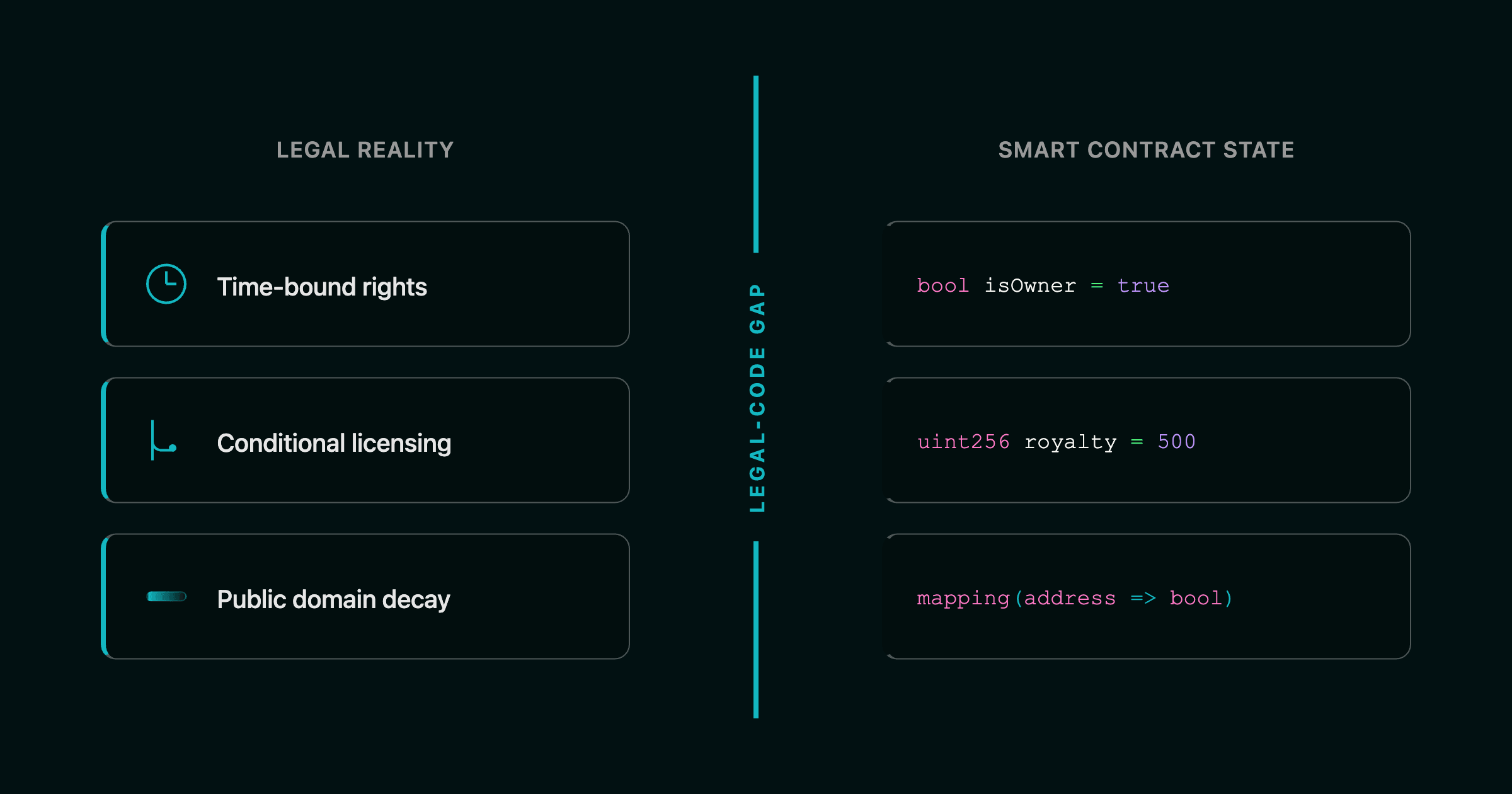

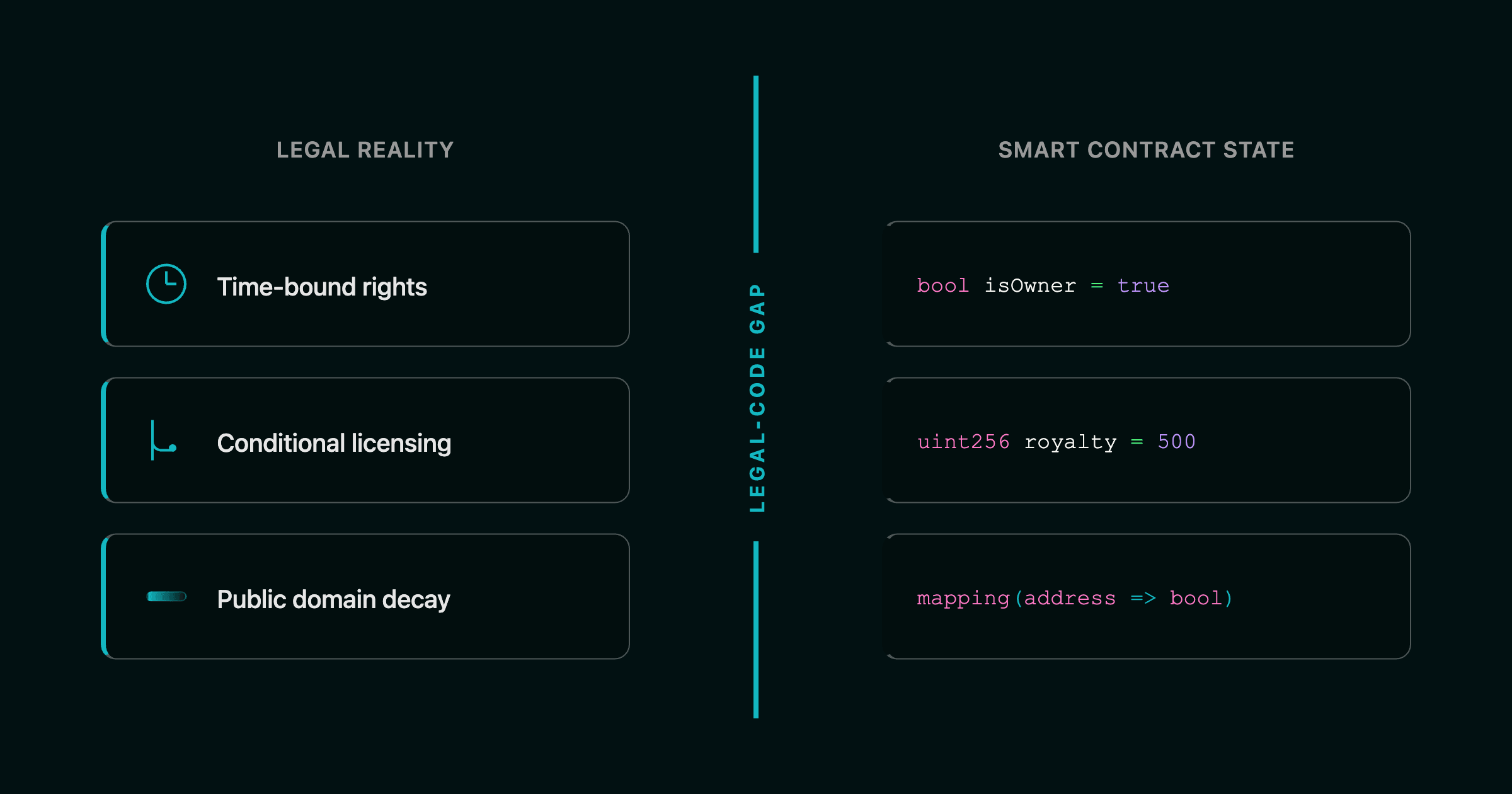

Standard NFT implementations—specifically ERC-721 and ERC-2981—are functionally insufficient for representing real-world Intellectual Property (IP). While these standards excel at tracking provenance and ownership, they fail to account for the dynamic lifecycle of IP: royalty waterfalls, tiered revenue thresholds, and the inevitable transition of assets into the Public Domain. This challenge parallels the broader problem of bringing off-chain assets on-chain, as explored in our guide on Real World Asset (RWA) tokenization architecture.

The primary engineering challenge is the "Legal-Code Gap." A smart contract's state is binary and immutable, but IP rights are time-bound and conditional. To build legally resilient IP assets, developers must move beyond static metadata and implement programmable rights that synchronize on-chain state with legal reality.

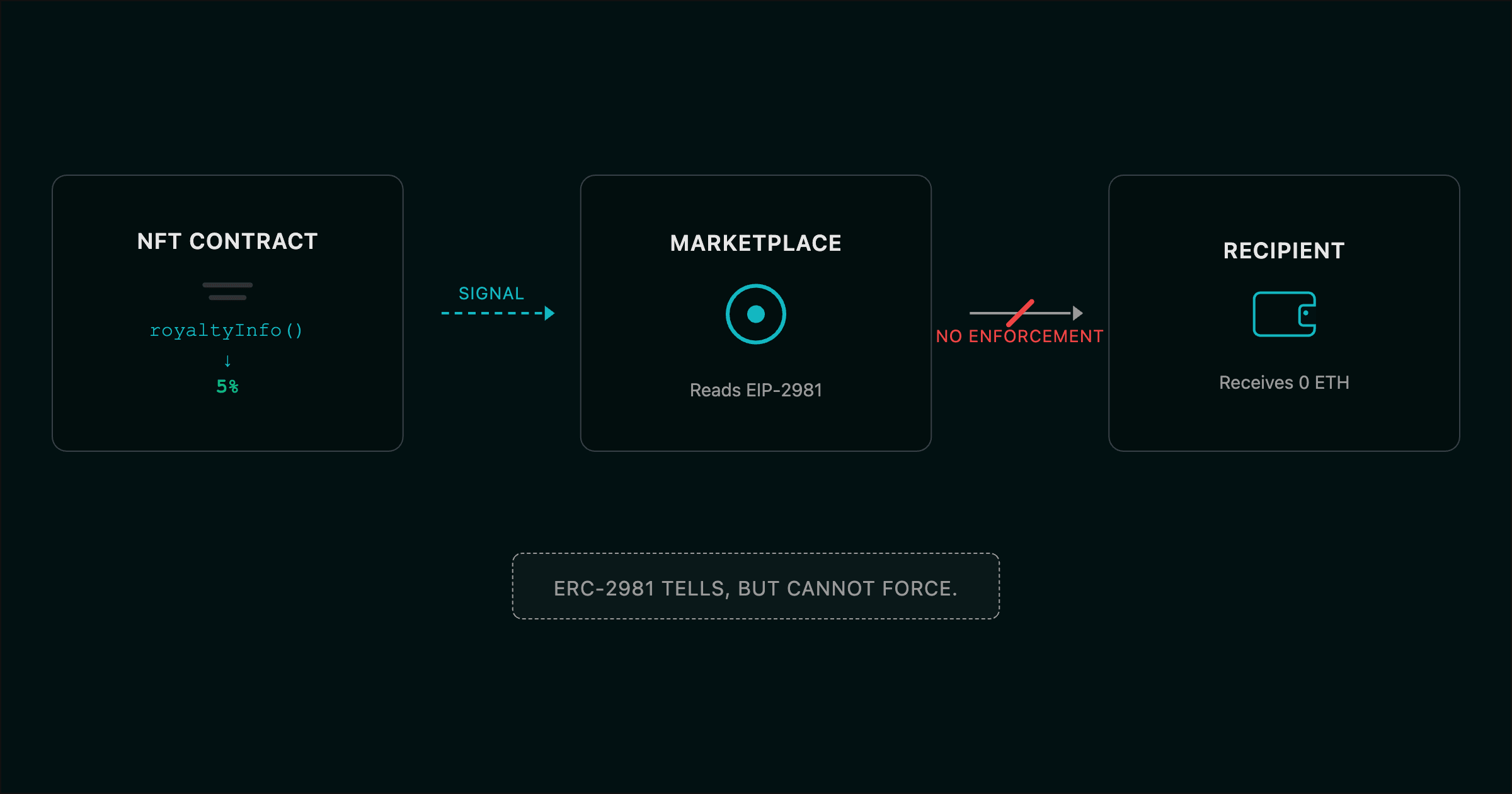

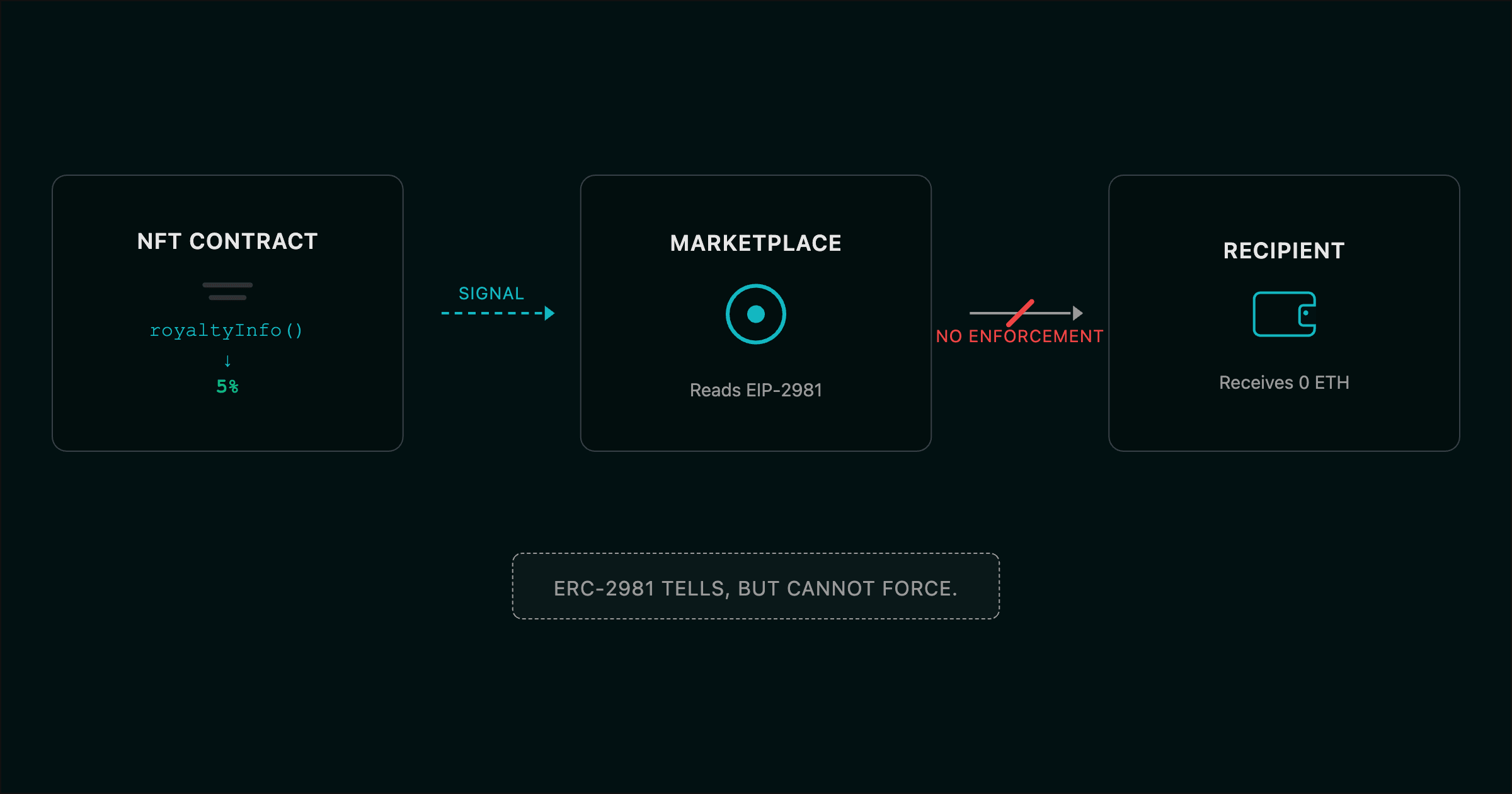

The problem with ERC-2981

ERC-2981 was designed as a signaling standard. It provides a

royaltyInfo function that returns a receiver and a royaltyAmount. However, it has two major limitations for IP:- Signaling vs. enforcement: The standard tells a marketplace what to pay, but it cannot force execution.

- Static defaults: Most implementations hardcode a fixed percentage. Real-world IP requires "State-Dependent Royalties" where the rate changes based on time or total revenue generated.

Pattern 1: The splitter architecture (pull vs. push)

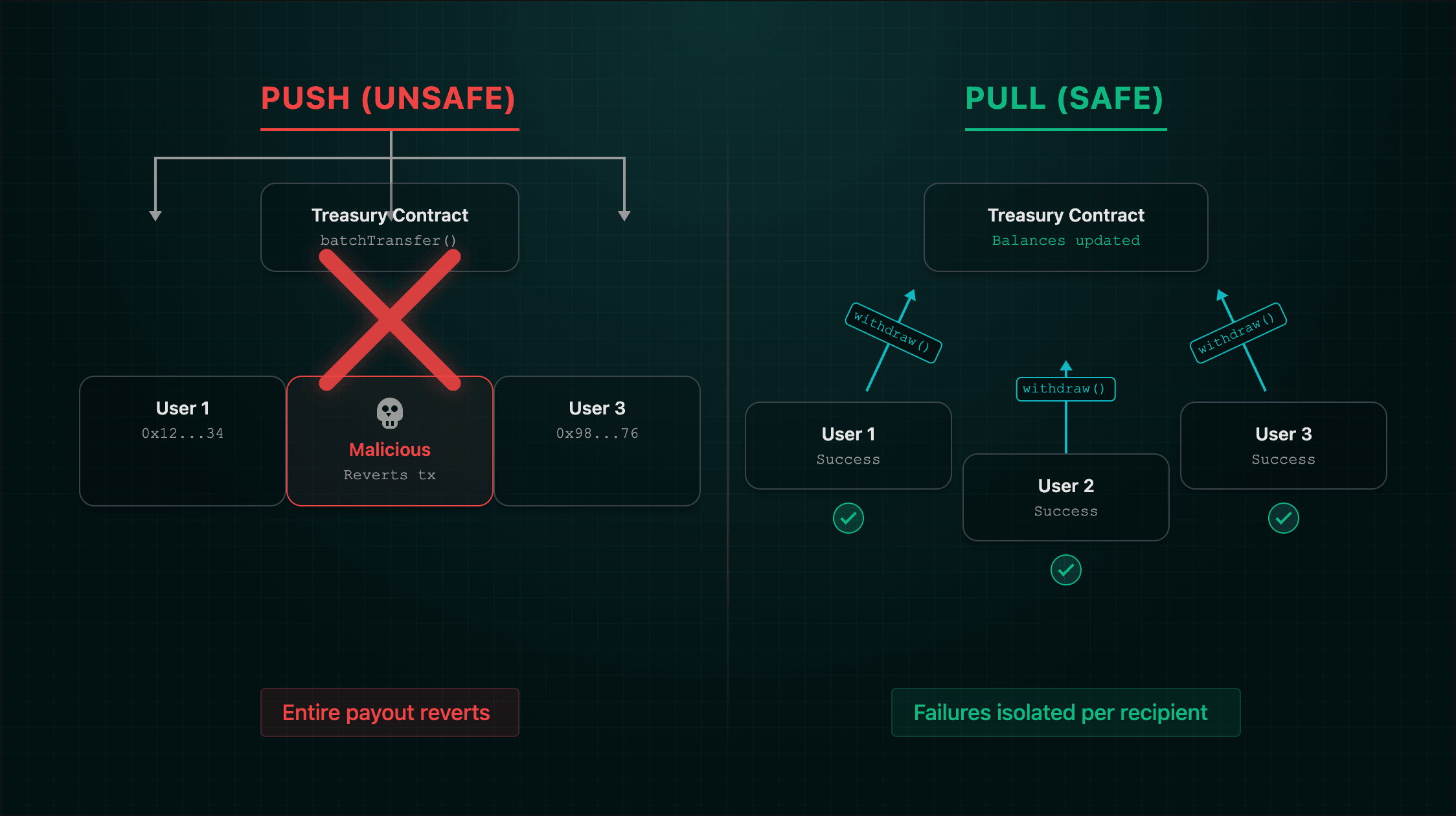

IP rarely has a single owner. A master recording typically involves splits between composers, producers, and performers.

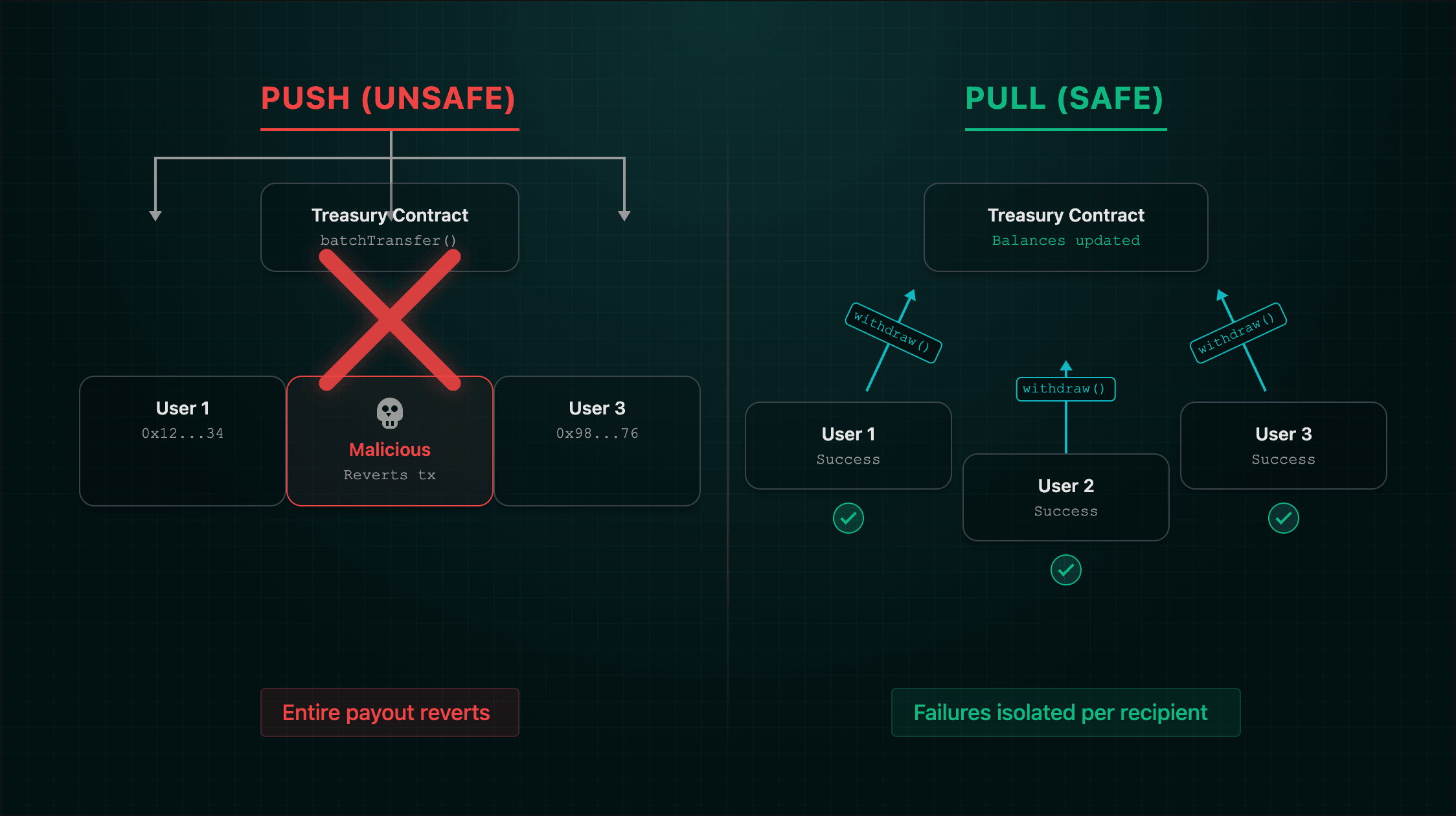

When implementing multi-party payouts, avoid the "Push" pattern (iterating through an array to send funds). This introduces a Denial of Service (DoS) vector if a single recipient is a malicious contract or if the array exceeds the block gas limit — a class of vulnerability we cover in depth in our front-running and DoS prevention guide. Instead, utilize a Pull Payment architecture.

Implementation: Liquid royalty splits

By tokenizing the splits themselves (similar to the 0xSplits architecture), you can decouple the right to receive royalties from the underlying IP.

1// Simplified logic for a state-dependent royalty receiver2function royaltyInfo(uint256 _tokenId, uint256 _salePrice)3 external4 view5 override6 returns (address receiver, uint256 royaltyAmount)7{8 // Receiver is a PaymentSplitter contract or a Liquid Split proxy9 uint96 currentRate = getDynamicRate(_tokenId);10 uint256 amount = (_salePrice * currentRate) / 10000;11 return (royaltyRegistry[_tokenId], amount);12}

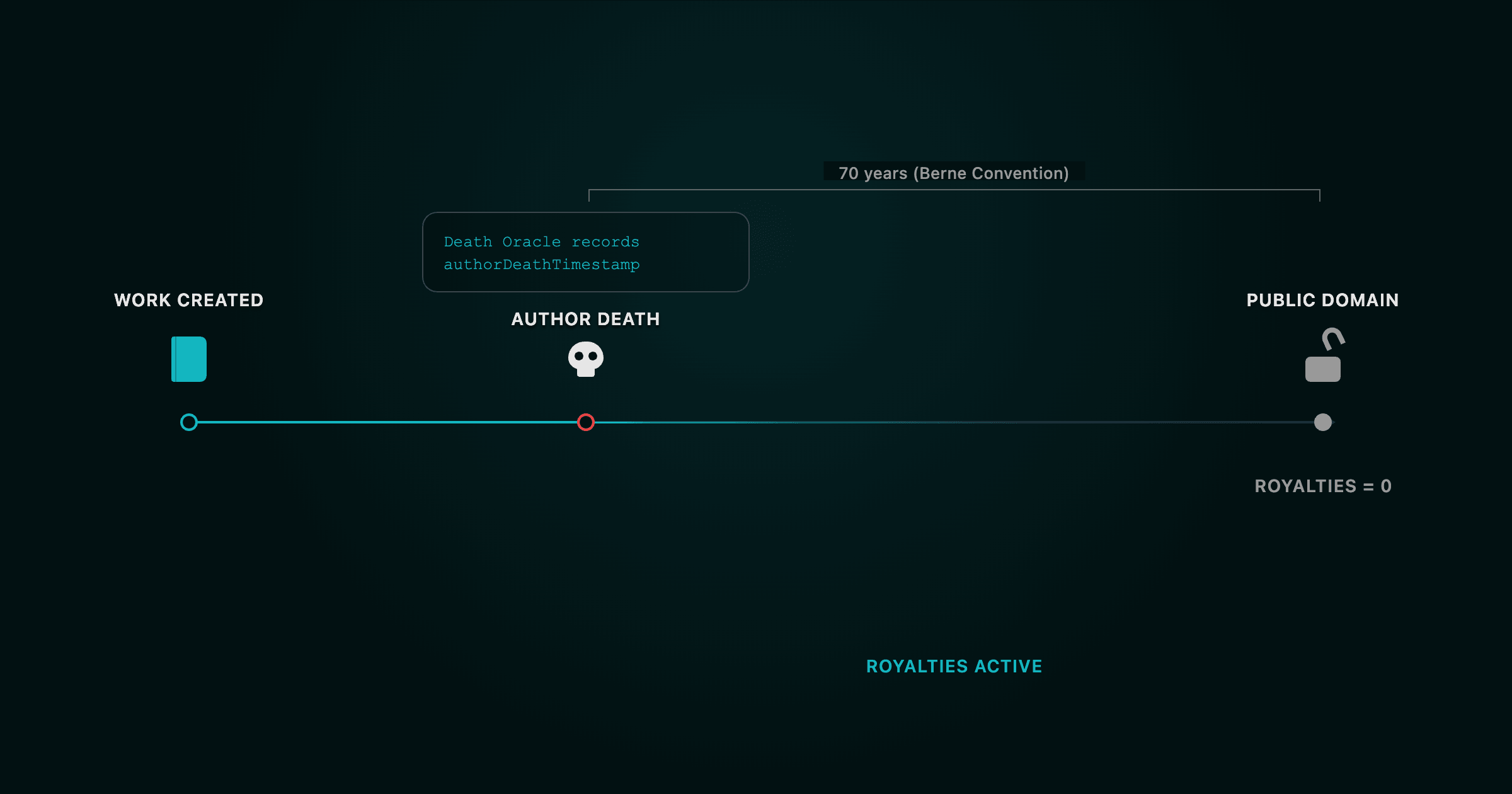

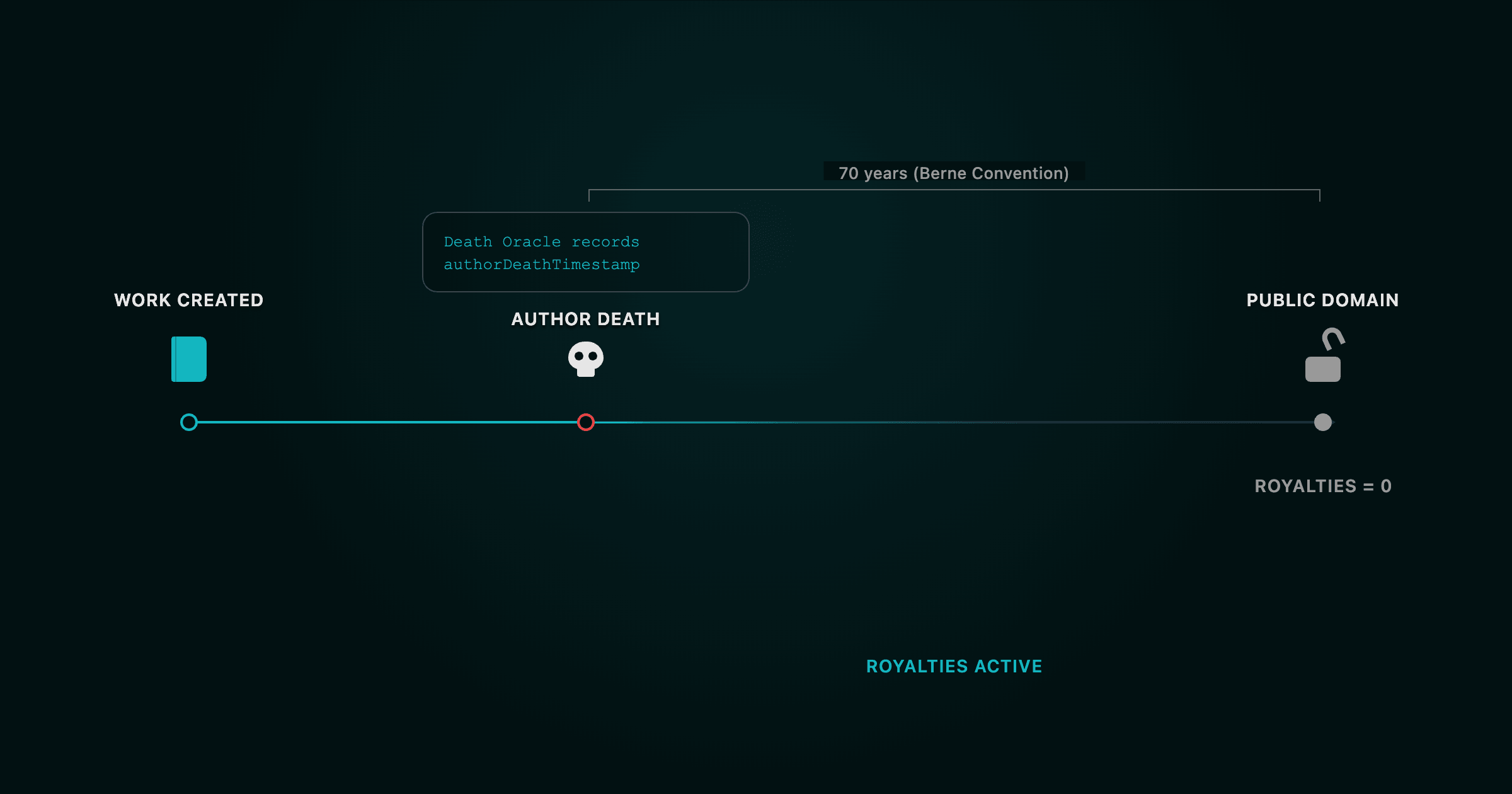

Pattern 2: Managing copyright decay and the "death oracle"

Under the Berne Convention, copyright is finite (typically life of the author plus 70 years). A smart contract that enforces royalties in perpetuity creates a "Zombie Copyright" that is legally unenforceable.

To mitigate this, you must implement a "Death Oracle" or a signaling mechanism that allows an authorized entity (e.g., a DAO or legal firm) to record the author's death, triggering a decay function.

Implementation: Expiration logic

The following implementation overrides

royaltyInfo to return zero once the protection term has expired.1contract IPAsset is ERC2981 {2 uint256 public constant PROTECTION_TERM = 25550 days; // 70 years3 uint256 public authorDeathTimestamp;45 // Triggered by an authorized legal oracle6 function recordDeath(uint256 _timestamp) external onlyOwner {7 require(authorDeathTimestamp == 0, "Already recorded");8 authorDeathTimestamp = _timestamp;9 }1011 function isPublicDomain() public view returns (bool) {12 if (authorDeathTimestamp == 0) return false;13 return block.timestamp > (authorDeathTimestamp + PROTECTION_TERM);14 }1516 function royaltyInfo(uint256 _tokenId, uint256 _salePrice)17 public18 view19 virtual20 override21 returns (address, uint256)22 {23 if (isPublicDomain()) {24 return (address(0), 0);25 }26 // Return standard royalty logic if still protected27 return super.royaltyInfo(_tokenId, _salePrice);28 }29}

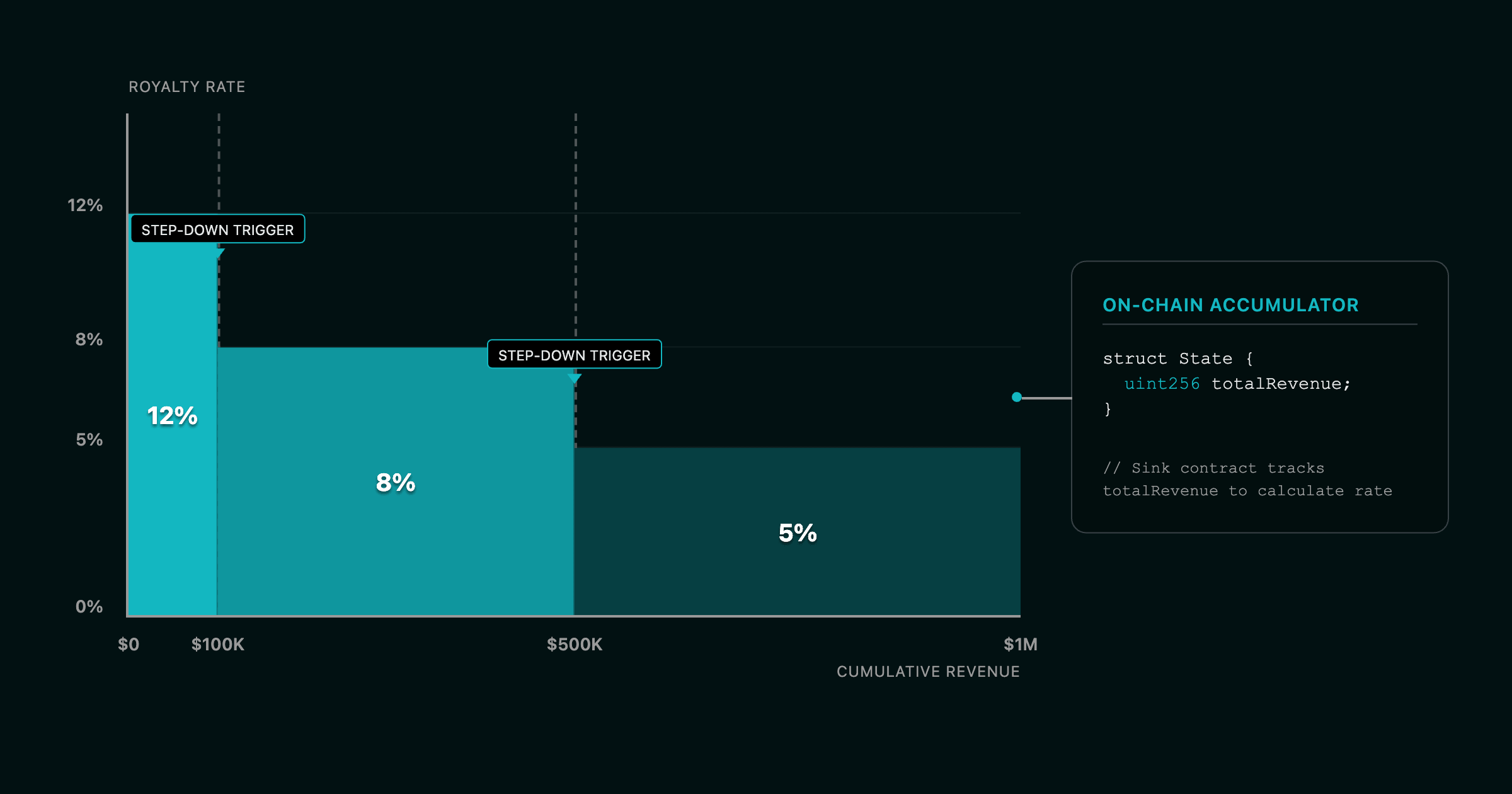

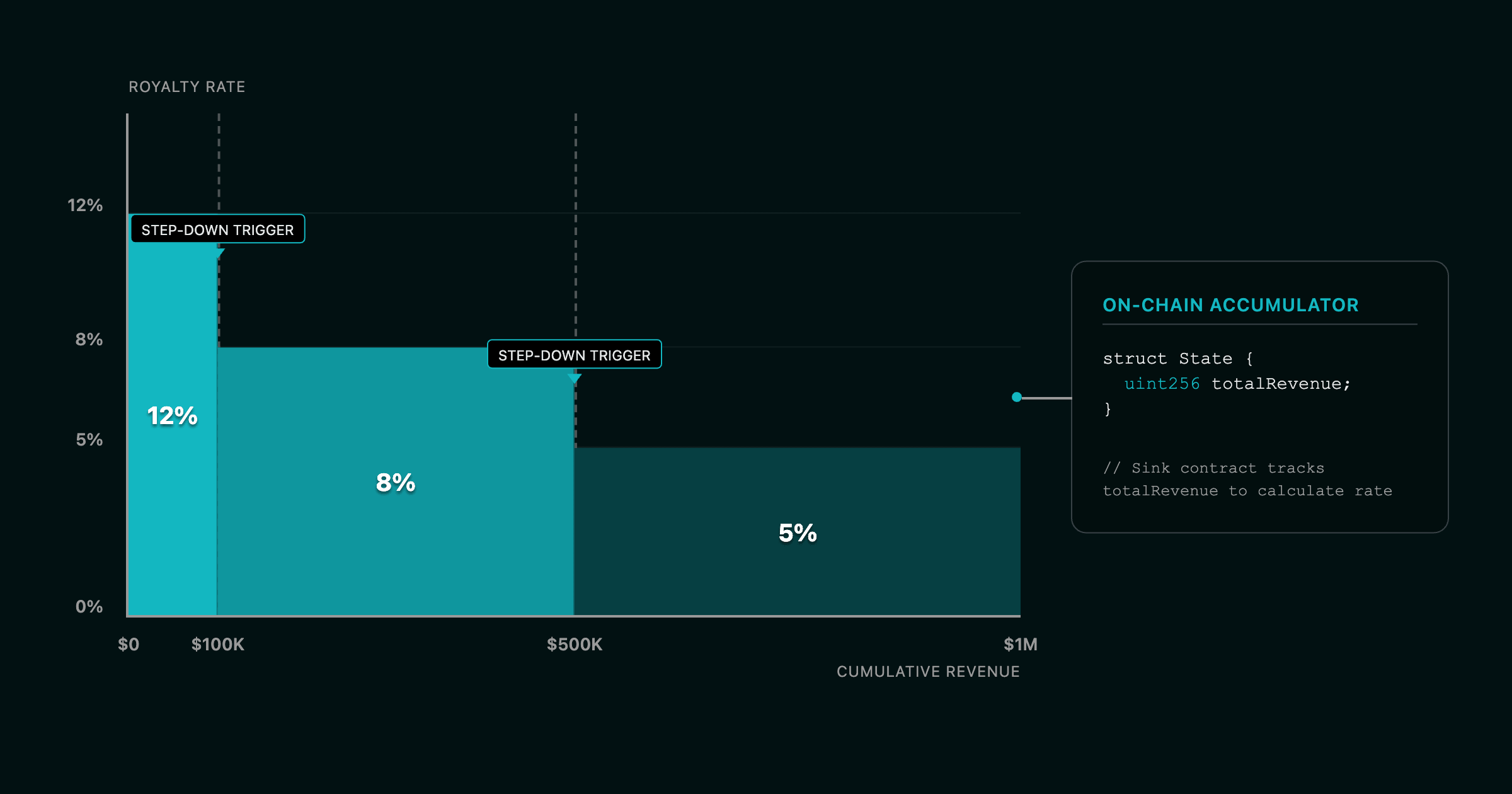

Pattern 3: Tiered revenue waterfalls

Commercial IP often utilizes "step-up" or "step-down" rates based on cumulative sales volume. Since

royaltyInfo is a view function, it cannot update state variables. Developers must use an On-Chain Accumulator pattern where the royalty revenue flows through a "Sink" or "Treasury" contract that updates the total revenue volume upon receipt.| Architecture | Source of truth | Gas cost | Use case |

|---|---|---|---|

| Static | Hardcoded Constant | Low | PFP Collections |

| Tiered | On-chain Accumulator | Medium | Book/Publishing Deals |

| Oracle-Based | Off-chain API (e.g., Spotify) | High | Music Performance Rights |

Pattern 4: The Ricardian contract binding

A token transfer is not a copyright transfer unless it is backed by a legal contract. The Ricardian Contract pattern binds legal prose to smart contract logic by hashing the legal agreement and storing it on-chain. For protocols that also need to enforce investor eligibility or regulatory restrictions on token holders, the ERC-1400 security token standard provides a complementary compliance layer. This ensures that the user is cryptographically signing the specific terms of the license.

1contract RicardianIP is ERC721 {2 // Hash of the legal PDF/Markdown hosted on IPFS/Arweave3 bytes32 public constant LEGAL_TERMS_HASH = 0x...;45 function mintLicense(address to, uint256 tokenId) public {6 // The minting transaction provides cryptographic proof of7 // acceptance of the LEGAL_TERMS_HASH8 _mint(to, tokenId);9 }1011 function verifyTerms(bytes32 _providedHash) external pure returns (bool) {12 return _providedHash == LEGAL_TERMS_HASH;13 }14}

Engineering the IP graph

Protocols like Story Protocol are moving away from isolated tokens toward hierarchical IP graphs. This shift mirrors the broader movement from permissionless ERC-20 tokens toward compliant, programmable asset standards. By treating IP as a network of "Parent" and "Child" assets, developers can automate derivative licensing. In this architecture, a "Licensing Module" mints tokens that grant specific rights (e.g., commercial use vs. remixing), while a "Royalty Module" enforces the recursive flow of value back to the root asset.

Conclusion

Transitioning IP to the EVM requires more than simple tokenization; it requires a modular architecture that accounts for legal decay and complex revenue routing. Using the Splitter pattern handles multi-party payouts safely, while Ricardian bindings and "Death Oracles" ensure that code remains synchronized with jurisdictional requirements. For developers, the goal is to build "Liquid IP" that is functionally compatible with the global creative economy's existing legal frameworks.

If your IP protocol uses upgradeable proxy patterns, ensure the royalty logic and death oracle cannot be silently overwritten — immutable rights require immutable enforcement. For teams operating in the EU, the MiCA regulation may impose additional disclosure and compliance requirements on tokenized IP products.

Before deploying to mainnet, validate your splitter and royalty logic with fuzz testing to catch edge cases in tiered revenue calculations and pull-payment flows.

Get in touch

At Zealynx, we audit tokenized IP protocols, RWA platforms, and custom ERC-2981 implementations. Whether you need a security review of your splitter architecture, compliance validation for ERC-1400 security tokens, or a full smart contract audit before mainnet deployment, our team is ready to assist — reach out.

Want to stay ahead with more in-depth analyses like this? Subscribe to our newsletter and ensure you don't miss out on future insights.

FAQ: Tokenizing intellectual property on the EVM

1. Why is ERC-2981 insufficient for tokenizing intellectual property?

ERC-2981 is a signaling standard, not an enforcement mechanism. It provides a

royaltyInfo function that tells marketplaces what royalty to pay, but it cannot force any marketplace to actually execute that payment. Most implementations also hardcode a fixed royalty percentage. Real-world IP requires state-dependent royalties — rates that change based on cumulative revenue, time elapsed, or legal events like copyright expiration — which ERC-2981 was never designed to handle.2. What is the EVM and why does it matter for IP tokenization?

The Ethereum Virtual Machine (EVM) is the runtime environment that executes smart contracts on Ethereum and EVM-compatible blockchains (Polygon, Arbitrum, Base, etc.). It matters for IP tokenization because it provides a deterministic, tamper-proof execution layer where royalty logic, ownership records, and licensing terms can be enforced automatically without relying on a centralized intermediary. Every state change (a royalty payment, a license transfer) is verifiable by anyone on the public ledger.

3. What is a "death oracle" and why is it needed for on-chain copyright?

A Death Oracle is a mechanism that records an author's death on-chain, triggering a countdown to the expiration of copyright protection. Under the Berne Convention (the international copyright treaty adopted by over 180 countries), copyright typically lasts for the life of the author plus 70 years, after which the work enters the Public Domain. Without a death oracle, a smart contract would enforce royalties in perpetuity, creating a legally unenforceable "Zombie Copyright" that contradicts international law and could expose the protocol to legal challenges.

4. What is the difference between push and pull payments, and why does it matter for IP royalties?

In a push payment model, the contract iterates through an array of recipients and sends funds to each one. This creates a critical Denial of Service (DoS) vulnerability: if any single recipient is a malicious contract that reverts on receive, or if the recipient array grows large enough to exceed the block gas limit, the entire payout fails for everyone. In a pull payment model, each recipient calls a

withdraw function to claim their share independently, isolating failures and eliminating the DoS vector entirely. For IP with multiple stakeholders (composers, producers, performers), pull payments are the only safe pattern.5. What is a Ricardian contract and how does it bind legal terms to a smart contract?

A Ricardian Contract is a legal agreement that is both human-readable and machine-readable. The full text of the license or IP agreement (stored on IPFS or Arweave) is cryptographically hashed, and that hash is stored on-chain. When a user mints or transfers a token, their signed transaction serves as cryptographic proof that they accepted the exact terms identified by that hash. This bridges the "Legal-Code Gap" — the disconnect between what a smart contract does and what a court would enforce — by creating a verifiable, immutable link between the code and the legal prose.

6. Should I get a smart contract audit before deploying a tokenized IP protocol?

Yes. Tokenized IP protocols combine financial logic (royalty splits, tiered revenue waterfalls), time-dependent state transitions (copyright decay), and legal bindings (Ricardian hashes) — a surface area that is significantly more complex than a standard NFT collection. Bugs in splitter logic can permanently lock funds, and errors in the death oracle or expiration logic can create unenforceable or illegal royalty claims. A professional smart contract audit combined with fuzz testing is essential to validate edge cases in tiered calculations and multi-party payout flows before mainnet deployment.

Glossary

| Term | Definition |

|---|---|

| ERC-2981 | Ethereum standard for signaling royalty payment information on NFT sales. |

| Ricardian Contract | A legal agreement whose hash is stored on-chain, binding legal prose to smart contract logic. |

| Pull Payment | A payment pattern where recipients withdraw funds themselves, avoiding DoS risks from push-based distribution. |