Back to Blog

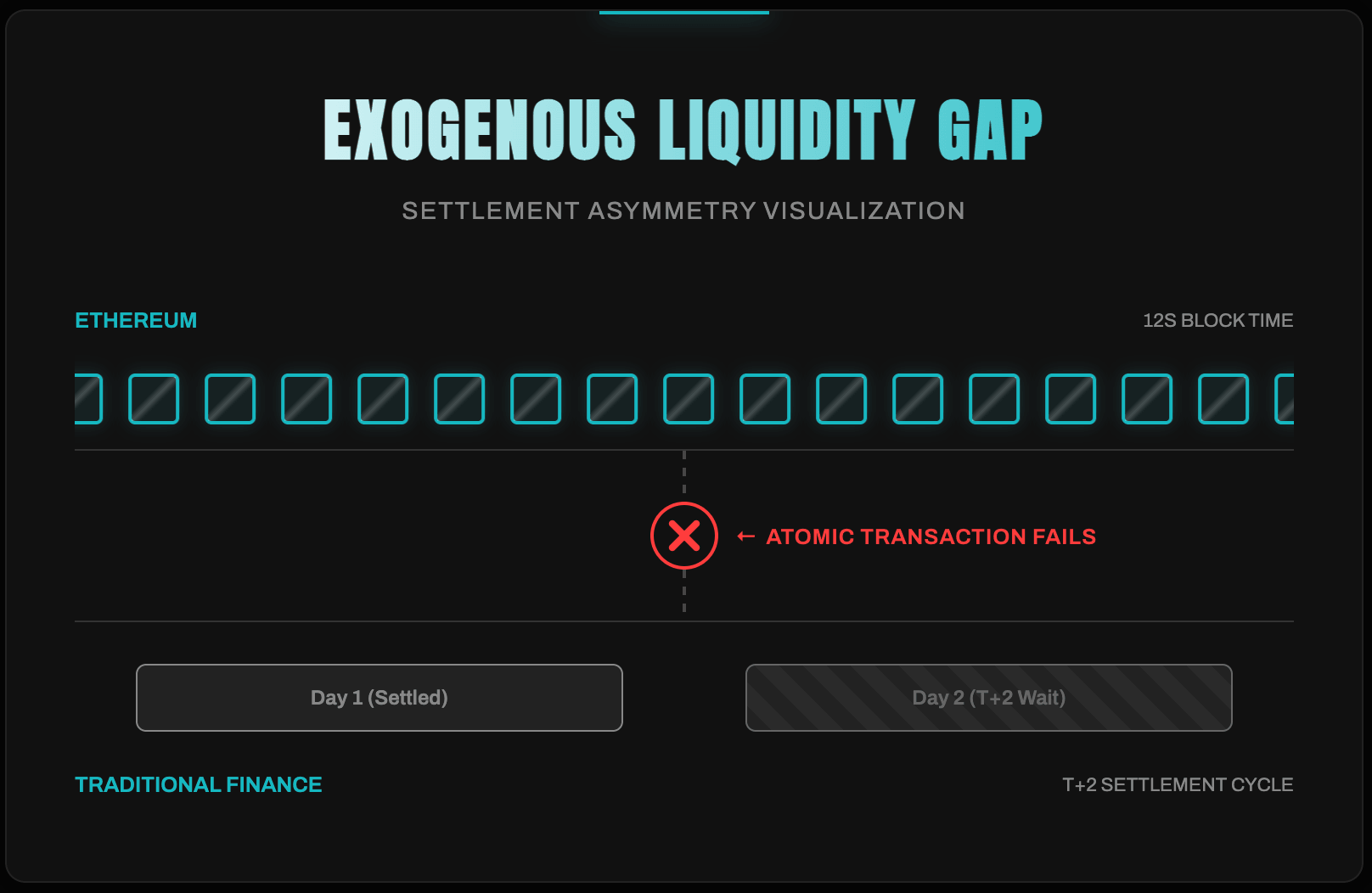

The standard ERC-4626 revolutionized DeFi by providing a unified interface for yield-bearing vaults. However, it relies on a fundamental assumption: atomic liquidity. In an ERC-4626 vault, deposits and redeems happen in the same transaction. This works for on-chain assets like Aave’s aTokens or Lido’s stETH, where the underlying liquidity is endogenous to the EVM.

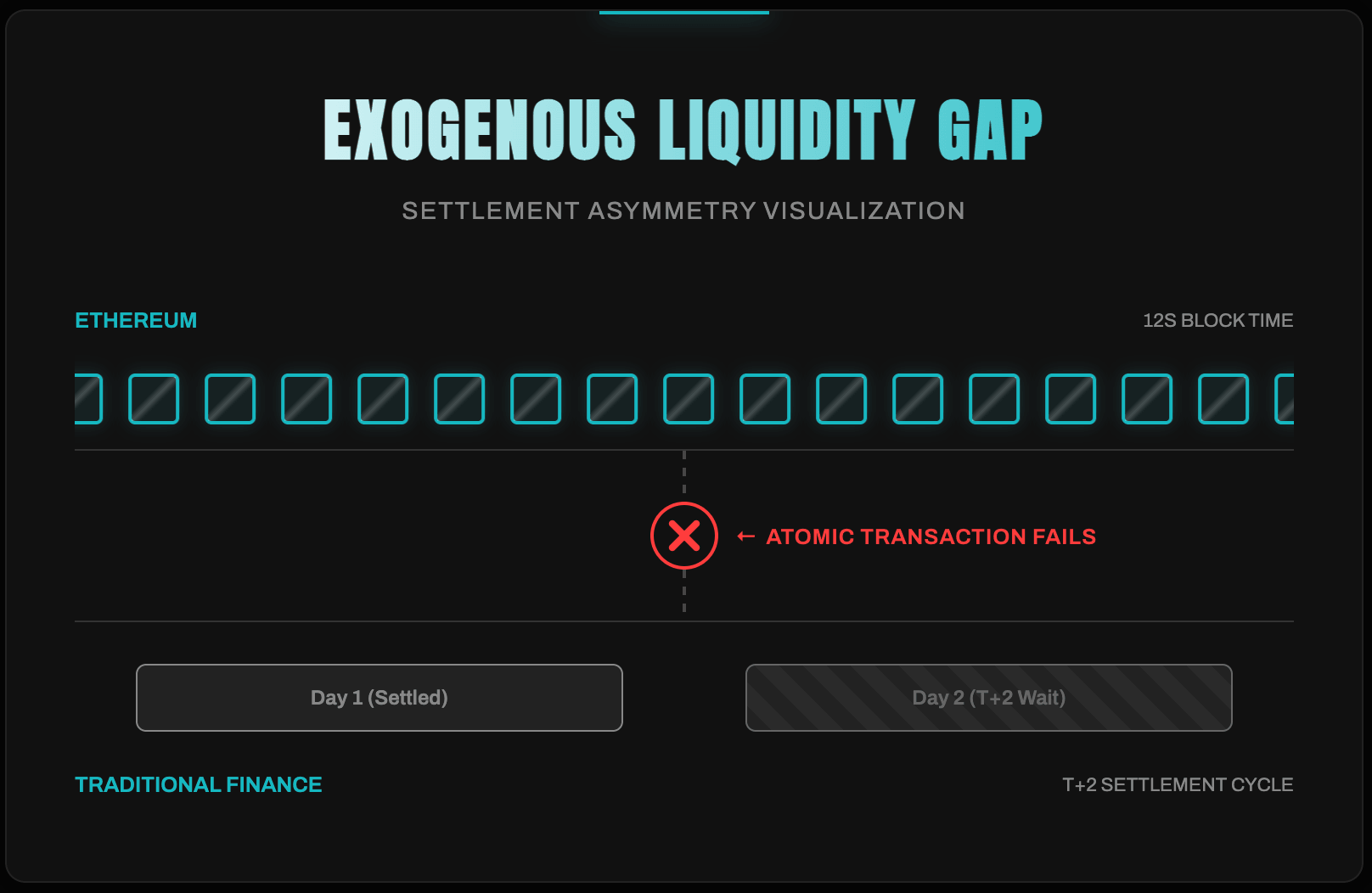

Real-World Assets (RWAs) break this assumption. When you tokenize a US Treasury bill or private credit, you are dealing with exogenous liquidity—assets that live in off-chain brokerage accounts, bank ledgers (Fedwire/Swift), or manual KYC registries. These systems operate on T+1 or T+2 settlement cycles, which are incompatible with Ethereum’s 12-second block time.

ERC-7540 is the technical extension designed to bridge this gap by formalizing an asynchronous request/claim pattern.

The friction: why atomic transactions fail for RWAs

If you attempt to force a T+2 settlement process into a standard ERC-4626

deposit function, you face three primary architectural failures:

- Unbacked Token Issuance: Minting shares before the off-chain wire transfer clears creates a period where the vault is technically under-collateralized.

- Settlement Reverts: If a

withdrawcall is made but the vault lacks immediate on-chain liquidity (due to assets being locked in a maturing bond), the transaction reverts, causing a Denial of Service (DoS) for the user. - Compliance Deadlocks: Institutional assets require KYC/AML checks that often happen via off-chain APIs or manual verification. These cannot be executed within the gas limit of a single synchronous transaction.

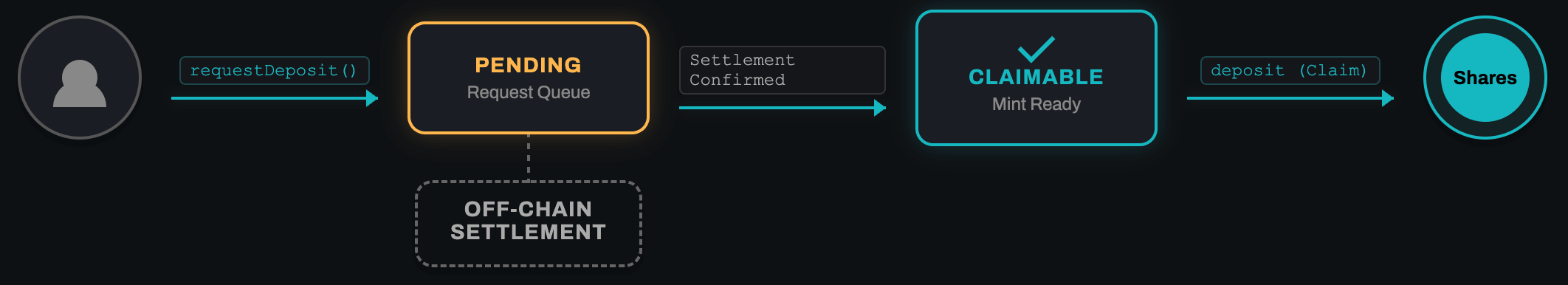

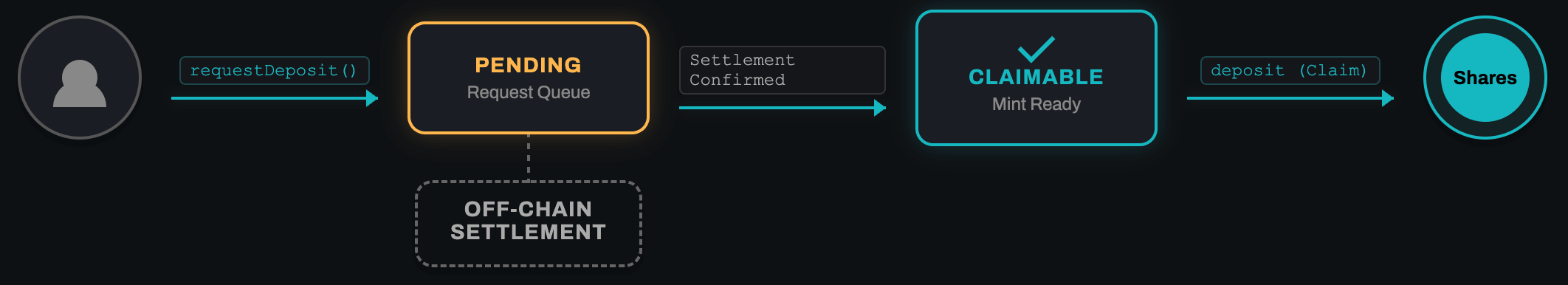

The mechanism: decoupling intent from execution

ERC-7540 solves this by introducing a state machine that separates the Request from the Fulfillment. It moves the vault from a "Push" model to a "Pull" model.

The lifecycle of an asynchronous operation follows three distinct states:

- Pending: The user calls

requestDeposit. Assets are transferred to the vault (or a locker), and arequestIdis generated. The user has committed funds but has not yet received shares. - Claimable: An off-chain operator or oracle confirms settlement (e.g., the wire transfer cleared). They update the vault state, moving the request from "Pending" to "Claimable."

- Claimed: The user (or a delegated bot) calls

deposit(overloaded in 7540) to finally mint the shares into their wallet.

Technical deep dive: key interface changes

ERC-7540 does not replace ERC-4626; it extends it. Here are the critical additions developers must implement:

1. The request flow

Instead of calling

deposit, users interact with:requestDeposit(assets, controller, owner)requestRedeem(shares, controller, owner)

Note the addition of the

controller parameter. This allows for delegated management, where an institutional custodian can manage the request flow on behalf of the owner without having full custody of the underlying assets.2. View functions for state tracking

Because the state is no longer binary, front-ends must query granular status:

pendingDepositRequest(requestId, controller): Returns assets waiting for settlement.claimableDepositRequest(requestId, controller): Returns assets/shares ready for finalization.

3. Handling forward pricing

In ERC-4626, the exchange rate is known at the time of the transaction. In ERC-7540, the exchange rate is typically determined at the time of fulfillment (Forward Pricing). This mitigates arbitrage risks but requires developers to manage Net Asset Value (NAV) updates carefully, often through epoch-based batching.

Implementation pattern: preventing atomic fallbacks

To ensure integrators do not accidentally treat an asynchronous vault as synchronous, the standard recommends overriding the original ERC-4626 functions to revert if an immediate operation is impossible:

1// Example: Enforcing the Asynchronous Flow2function deposit(uint256 assets, address receiver) public override returns (uint256) {3 // Revert to signal that users must use requestDeposit4 revert("ERC7540: Use requestDeposit for async flow");5}67function previewDeposit(uint256 assets) public view override returns (uint256) {8 // Signal to UI that atomic estimation is not available9 revert("ERC7540: Vault is asynchronous");10}

Institutional use cases and batching

The

requestId is the most powerful tool for RWA integrators. It allows for Batch Settlement (Epochs):

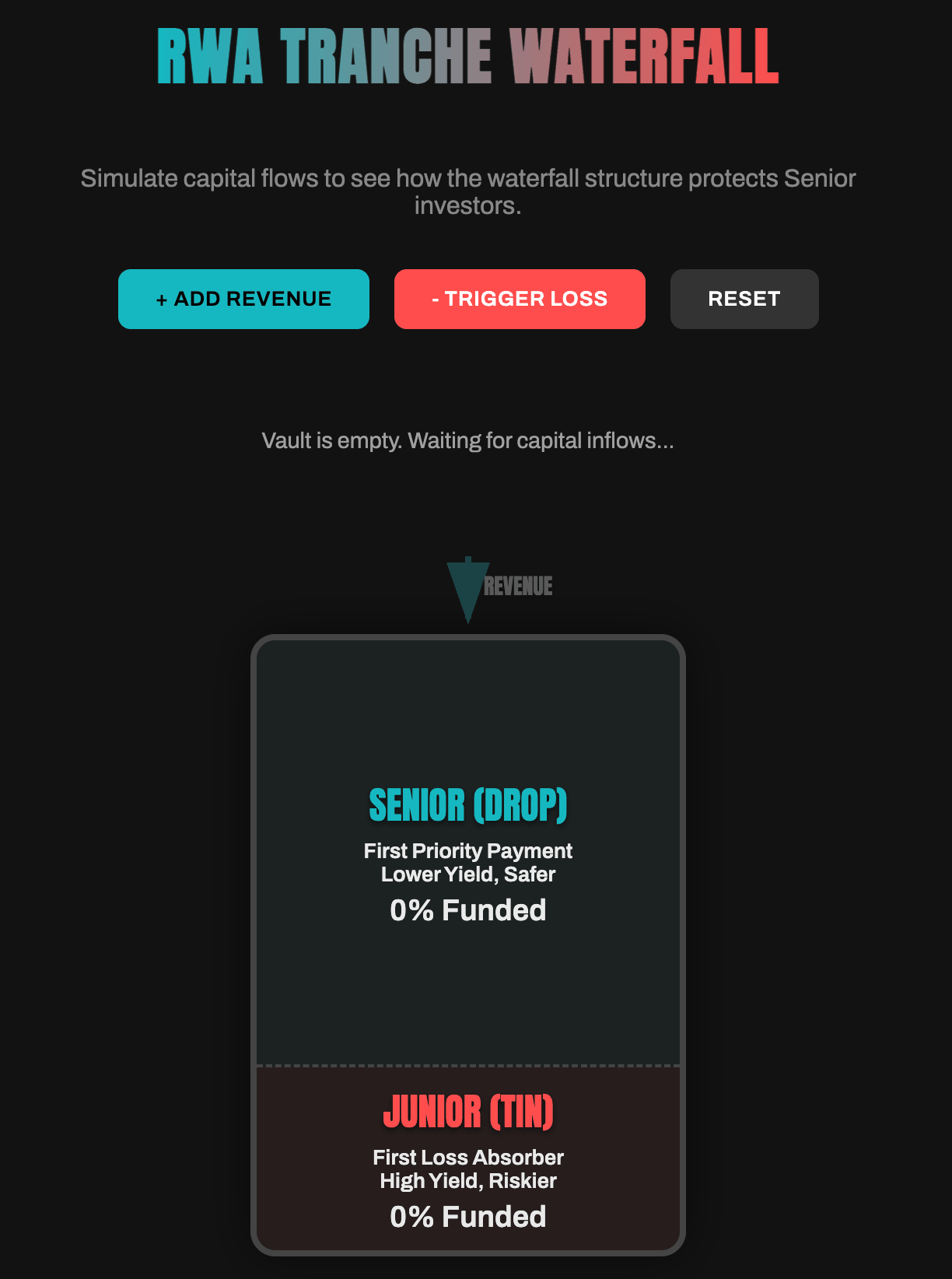

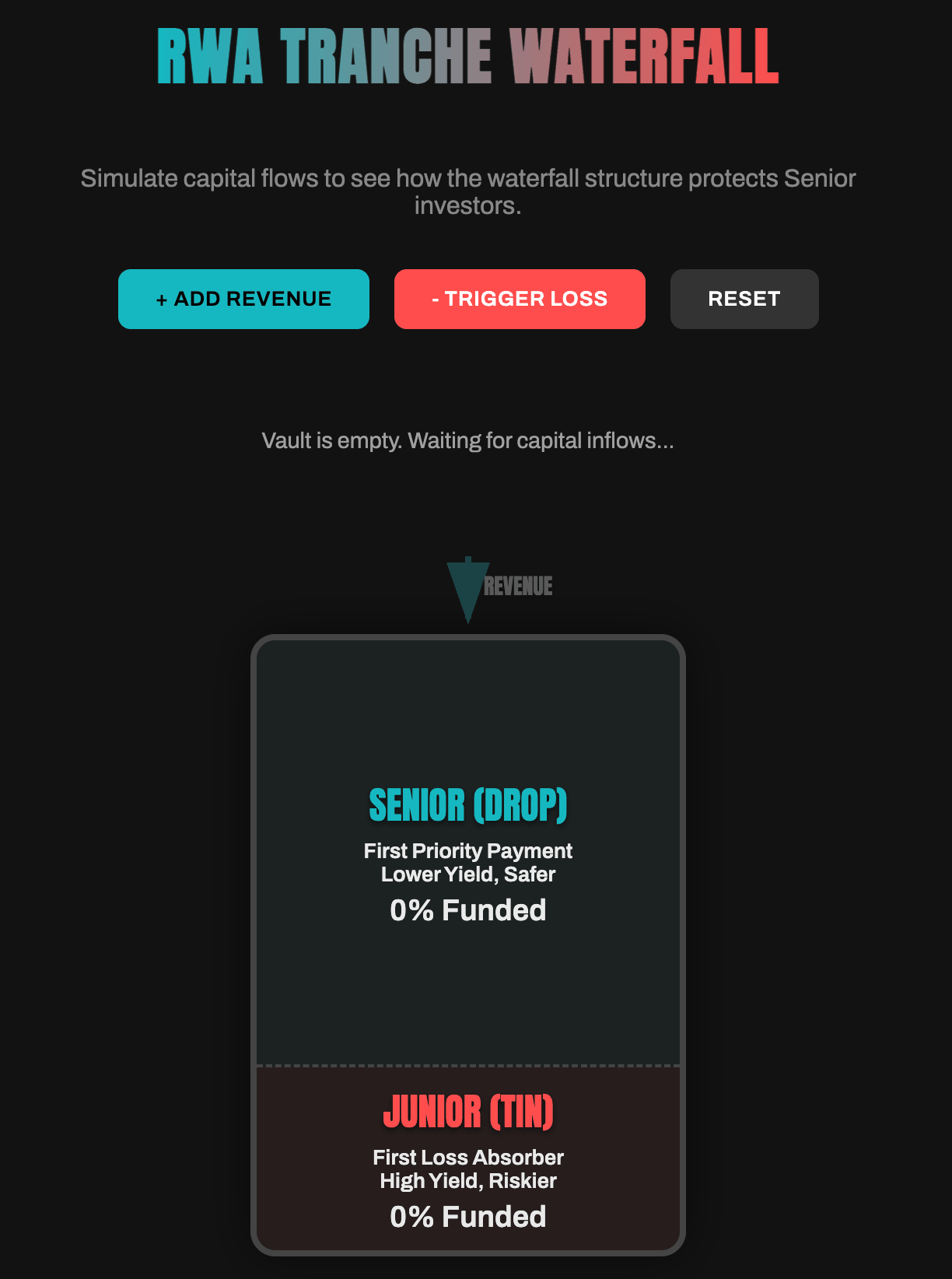

- Centrifuge: Uses 7540 to manage tranches. Requests are collected over an epoch (e.g., 24 hours). At the end of the epoch, a single NAV update processes all requests at the same price, ensuring fairness among participants and preventing front-running of off-chain data.

- Ondo Finance / Superstate: These protocols use the request phase to trigger off-chain subscription forms and bank wires. The "Claimable" state is only reached once the custodian (e.g., BNY Mellon) confirms the purchase of the underlying Treasury bills.

Security considerations: the "naked redeemer" risk

Developers must be aware of the Naked Redeemer problem. When a user calls

requestRedeem, their shares are typically burned or locked. If the vault becomes insolvent or the off-chain asset fails to liquidate during the "Pending" window, the user is left without shares (proof of ownership) and without assets.Mitigation: Implementation of a

cancelRedeem function (or similar extension) is critical to allow users to reclaim their shares if the asynchronous fulfillment window exceeds a specific timeout. See ERC-7887 for a standardized approach to cancellations.Next steps for implementation

If you are building a vault for non-liquid assets, do not force-fit it into a standard ERC-4626. This creates a brittle UX and potential security vulnerabilities.

- Review the Specification: Study the formal EIP-7540 proposal.

- Reference Implementation: Explore the Centrifuge ERC-7540 GitHub repository for production-grade examples of asynchronous state management.

- Audit Focus: If auditing these vaults, focus on the transition logic between

pendingandclaimableto ensure no "dust" attacks can stall the fulfillment queue.

Get in touch

At Zealynx, we understand that tokenizing real world assets requires more than just Solidity—it requires a robust architecture that bridges the gap between legal frameworks and blockchain state. Whether you are building an RWA platform, implementing ERC-7540 for asynchronous settlement, or auditing a tokenized asset infrastructure, our team is ready to assist — reach out.

Want to stay ahead with more in-depth analyses like this? Subscribe to our newsletter and ensure you don’t miss out on future insights.

FAQ: ERC-7540 & asynchronous vaults

1. Why not just use ERC-4626?

ERC-4626 assumes atomic (instant) liquidity, meaning assets must be available in the contract at the exact moment of withdrawal. Real-World Assets often rely on T+2 settlement cycles (wire transfers, bond sales), making them incompatible with atomic standards. ERC-7540 extends 4626 to handle these delays gracefully.

2. What is the "Naked Redeemer" risk?

This occurs when a user requests a redemption and their shares are locked or burned, but the off-chain settlement fails or the vault becomes insolvent before the fiat is sent. ERC-7540 implementations must include safeguards (like

cancelRedeem) to allow users to recover their shares if settlement fails.3. Can ERC-7540 be used for fully on-chain assets?

Yes, but it is often unnecessary. Using an asynchronous pattern for fully liquid on-chain assets (like ETH or DAI) introduces extra complexity and gas costs without providing benefit. It is best reserved for assets with inherent settlement delays or rate limits.

4. What does T+2 settlement mean for tokenized assets?

T+2 (Trade plus 2 days) refers to traditional financial settlement cycles where transactions complete two business days after the trade date. For example, when buying US Treasury bills through a broker, the actual transfer of ownership and payment happens 2 days later. This is incompatible with Ethereum's instant finality, which is why ERC-7540's request/claim pattern is needed to bridge the timing gap between blockchain transactions and off-chain settlement systems like Fedwire or SWIFT.

5. What is forward pricing and why does ERC-7540 use it?

Forward pricing means the exchange rate (how many vault shares you receive per asset deposited) is determined at fulfillment time, not at request time. In ERC-7540, when you call

requestDeposit, you don't know the exact share amount yet. The price is calculated when the vault's Net Asset Value (NAV) updates, typically at epoch close. This prevents arbitrage attacks where users could exploit stale pricing by front-running NAV updates with knowledge of off-chain asset price changes.6. What is the controller parameter in ERC-7540?

The

controller parameter in functions like requestDeposit(assets, controller, owner) enables delegated management for institutional custody. It separates the entity initiating the request (controller) from the ultimate asset owner. For example, a regulated custodian like BNY Mellon can act as the controller to manage deposit/redeem workflows on behalf of the owner, handling KYC verification and compliance checks, without needing full custody of the owner's tokens or shares.Glossary

| Term | Definition |

|---|---|

| Asynchronous Settlement | Request/claim pattern separating user intent from execution, enabling off-chain T+2 settlement cycles within blockchain transactions. |

| Exogenous Liquidity | Assets residing outside the EVM in off-chain systems like brokerage accounts, bank ledgers (Fedwire/SWIFT), or KYC registries. |

| Forward Pricing | Exchange rate determination at fulfillment time rather than request time, preventing arbitrage from stale NAV data in asynchronous vaults. |

| Epoch-based Batching | Settlement pattern collecting requests over a time period and processing all at the same NAV, ensuring fairness and preventing front-running. |

| Naked Redeemer | Security risk where user's shares are burned/locked during redemption request but off-chain settlement fails, leaving user without assets or proof of ownership. |