Back to Blog

You've spent three months building a protocol. You've fuzzed the invariants, written a comprehensive test suite in Foundry, and documented the logic. Then the audit quotes come in, and the range is nonsensical-one firm asks for $15,000, another for $150,000.

It feels like a "brand tax," but in 2026, the gap between a "cheap" audit and a "real" one is wider than ever. The price isn't just about the name on the PDF; it's a reflection of the technical debt and security complexity you're asking someone else to sign off on. Understanding what drives professional smart contract audit pricing helps you budget effectively and choose the right level of security review for your protocol.

If you're managing a security budget this year, here is why the math has changed.

The myth of the flat fee

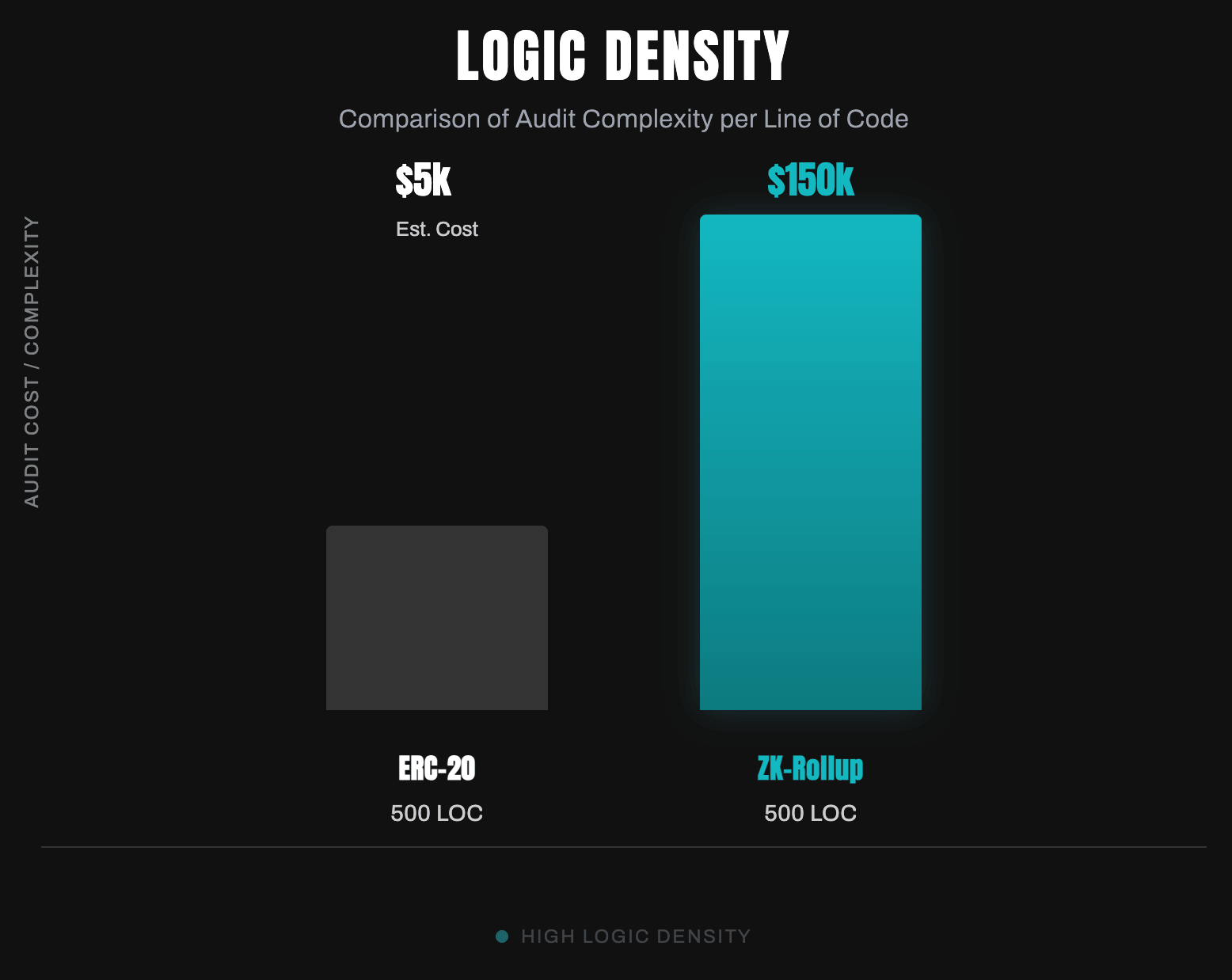

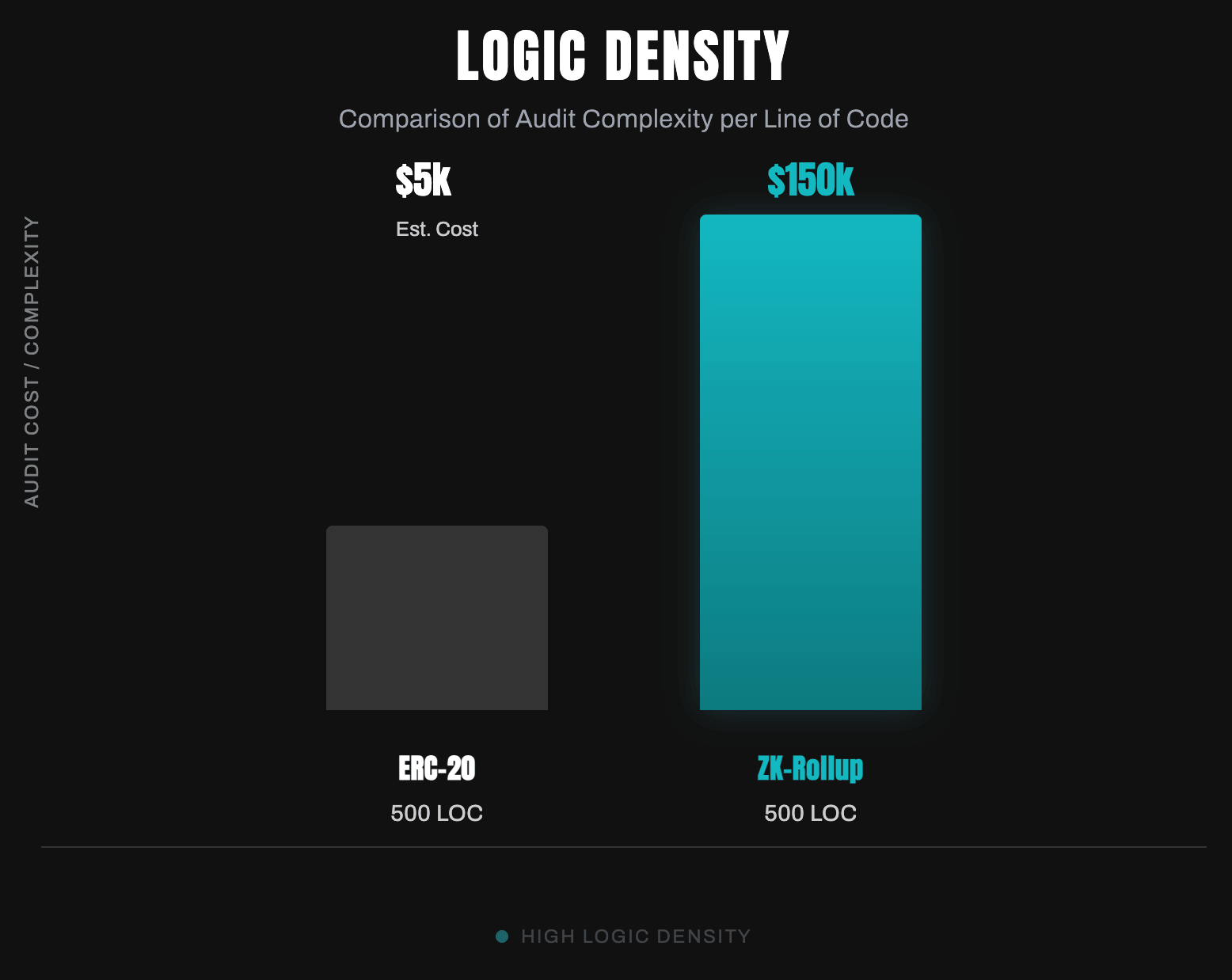

The days of "price per line of code" are effectively over. In 2026, auditors look at Logic Density.

A 500-line ERC-20 token is a solved problem; you can get that audited for $5k-$15k because it's mostly boilerplate. But if those same 500 lines handle cross-chain state synchronization or Zero-Knowledge Proofs (ZKPs), the price triples.

Audit firms are now pricing based on:

- The "Non-EVM" Premium: Rust (Solana) and Move (Aptos/Sui) experts are still rarer than Solidity devs. If you aren't building for the EVM, expect a 20-30% markup simply because the talent pool is smaller.

- The Urgency Tax: Requesting a 2-week turnaround for a complex protocol isn’t just "expedited." It requires pulling senior engineers off other projects. In this market, that "rush fee" is a 10-20% premium. It’s effectively a tax on poor project management.

- Regulatory Logic: With MiCA (Europe) and SEC guidelines (US) fully in play, auditors now have to check if your "admin" functions comply with legal freezing requirements, especially for RWA security standards. Adding this "compliance layer" to an audit usually adds up to the bill.

Why you can't "internalize" this (the mind trick)

You might think: "We have senior engineers. We’ll just run Slither, use an LLM-based scanner, and do a peer review. Why pay $100k?"

Here is the trap: AI scanners in 2026 are great at finding "code-level" bugs-reentrancy, integer overflows, or basic access control. But they are historically terrible at finding economic exploits.

An internal team is too close to the project to see the "Logic vs. Intent" gap. A professional auditor isn't just looking for bugs; they are looking for the ways your intended logic can be weaponized against your TVL. The $100k isn't for the tool they use; it's for the 10,000 hours the human has spent watching protocols get drained.

2026 pricing benchmarks

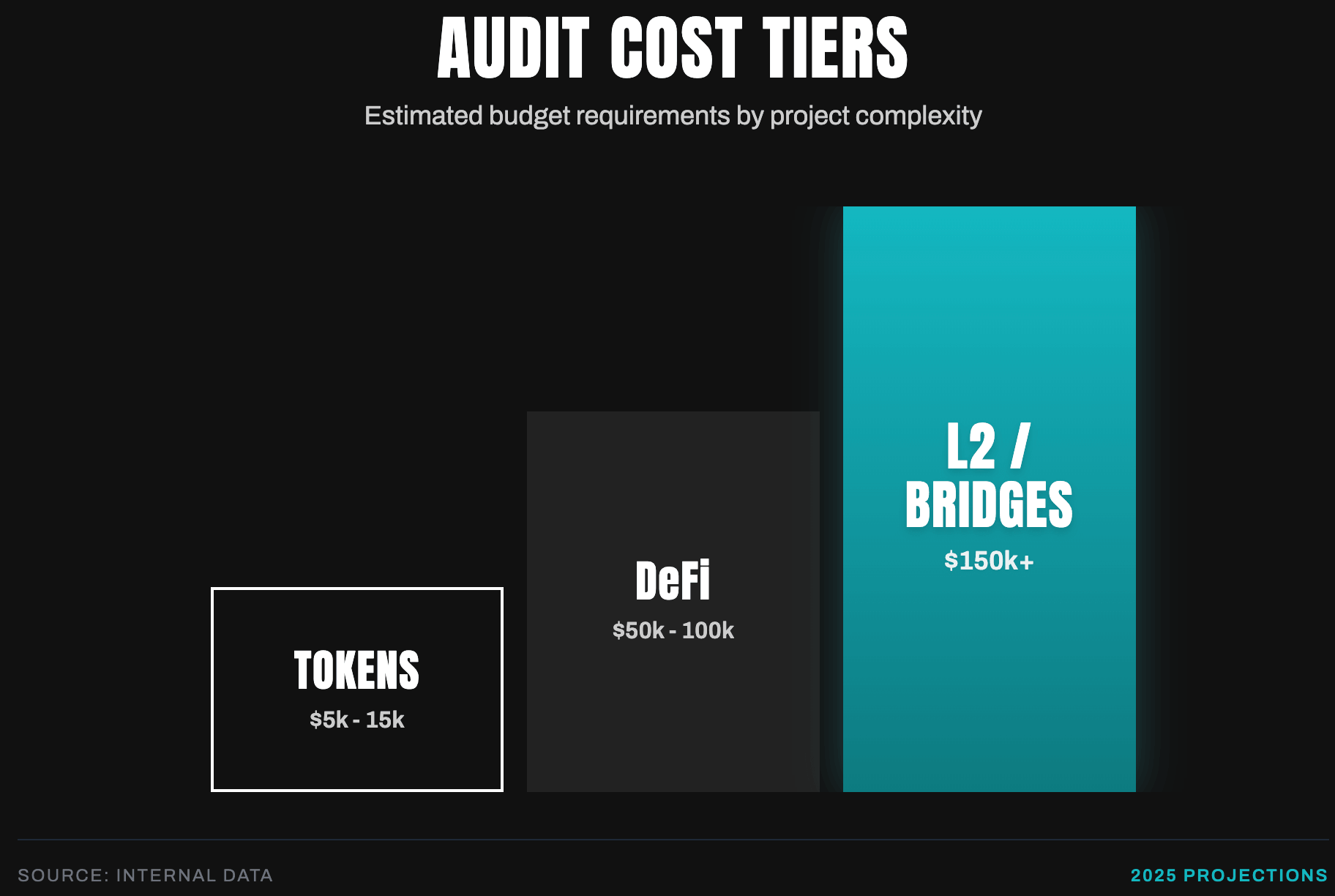

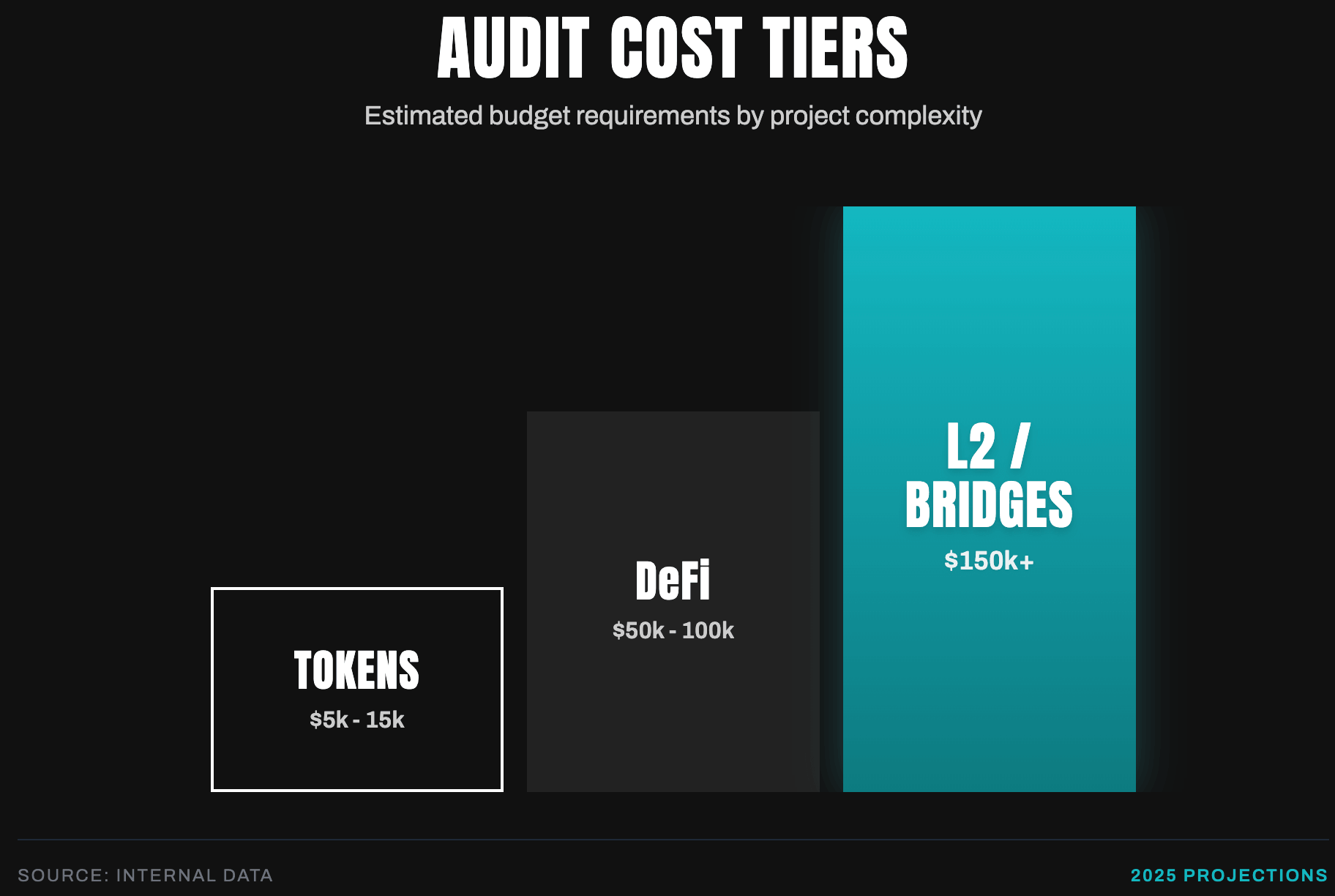

If you're budgeting for the next quarter, here is what the market looks like right now:

- Simple Tokens/NFTs: $5,000 – $15,000 (2-5 days).

- Standard DeFi (DEXs, Lending): $50,000 – $100,000 (3-6 weeks).

- High-Complexity (Bridges, L1s, ZK-Rollups): $150,000 – $500,000+ (2-6 months).

- Formal Verification (FV): If you want mathematical proof that your invariants can't be broken, add $20,000 – $50,000 to the base price. For a bridge, this is no longer optional; it’s a requirement for institutional trust.

The shift from CapEx to OpEx

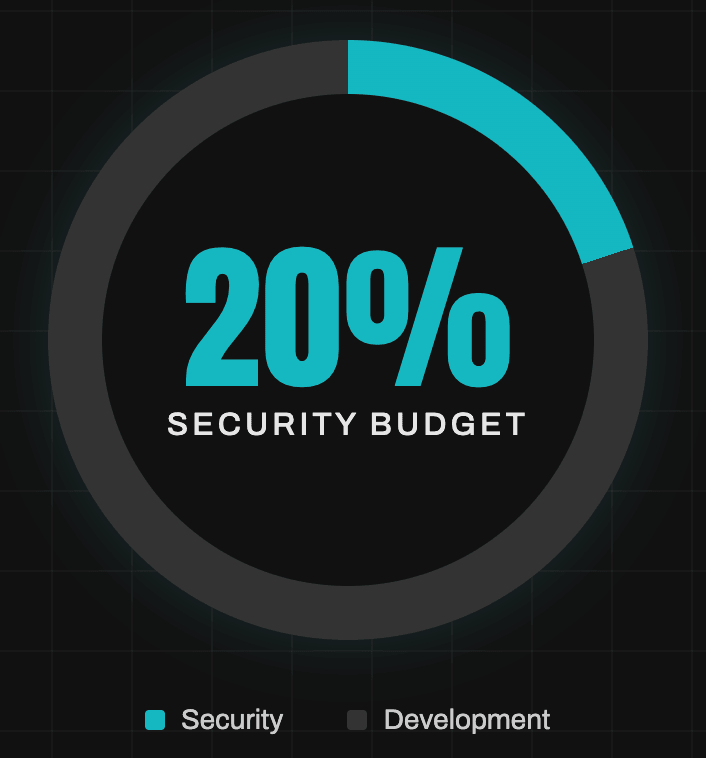

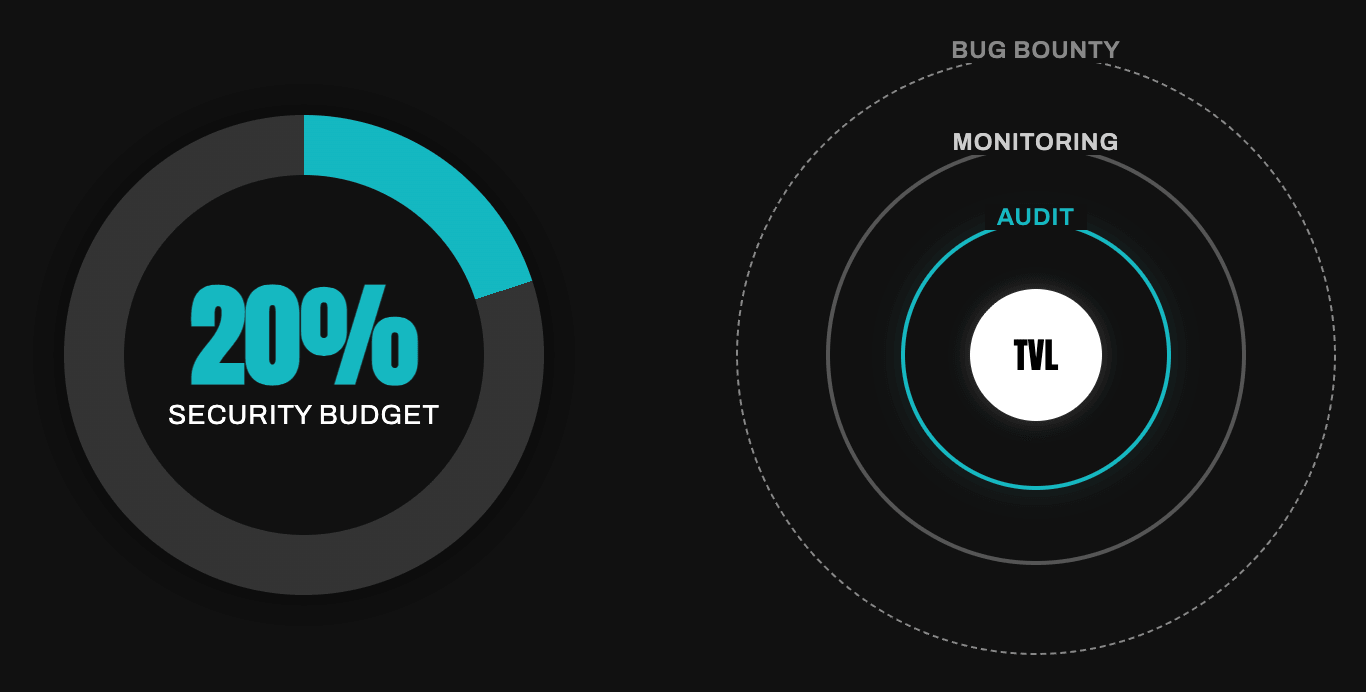

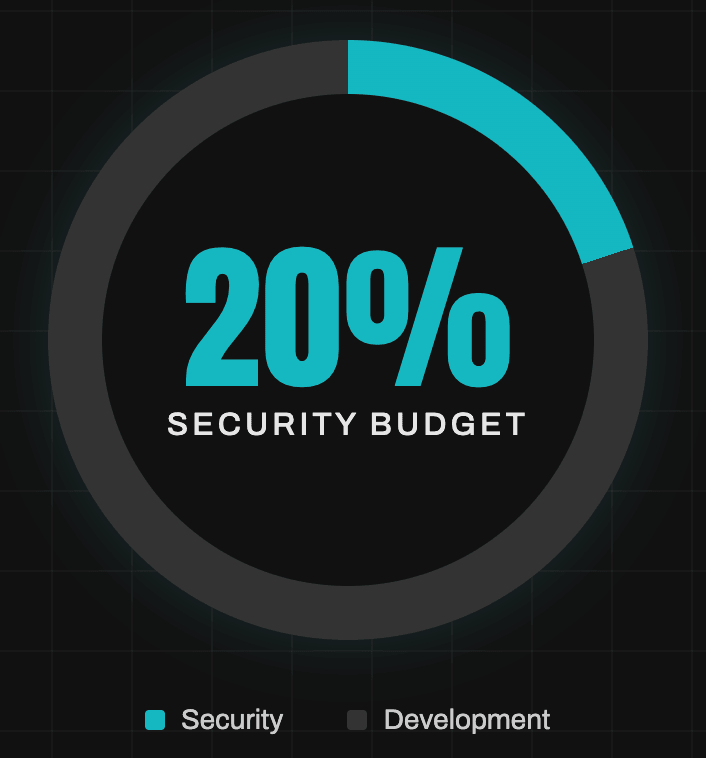

In the past, an audit was a one-time "gate" you passed through. In 2026, security is an ongoing operational expense.

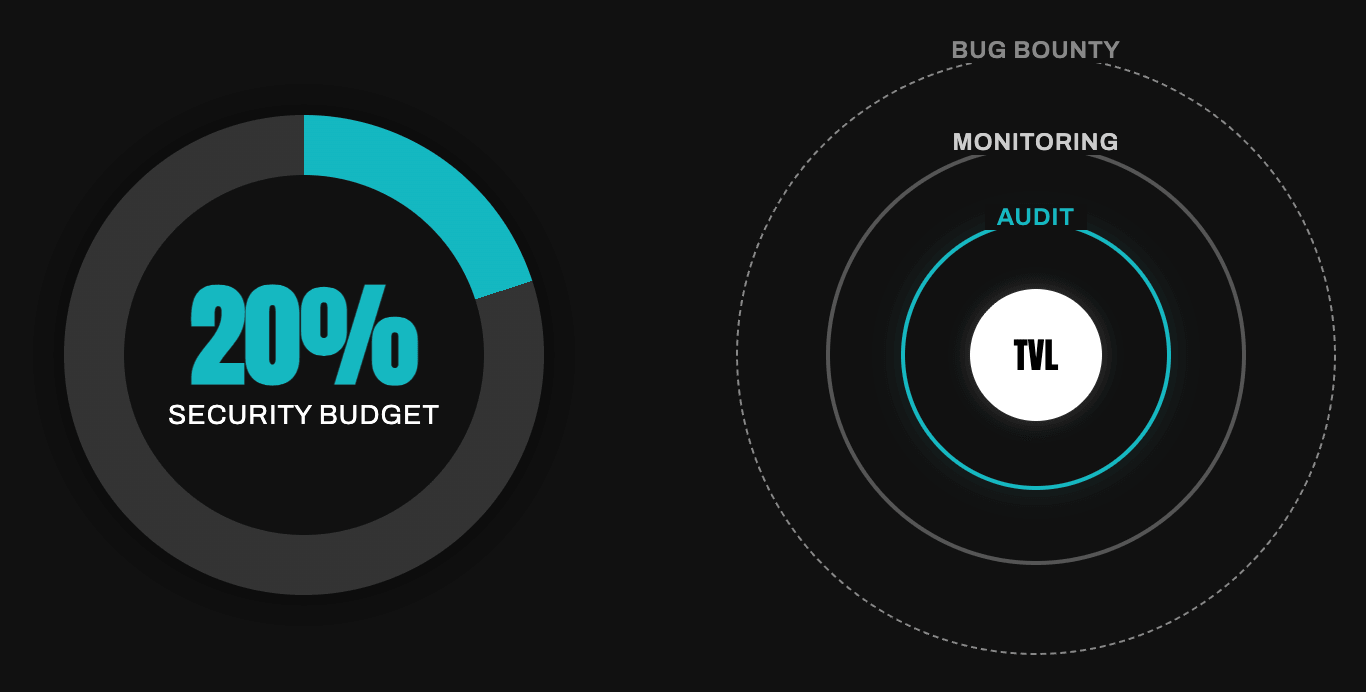

Smart teams are now allocating 15-20% of their annual development budget to "Security-as-a-Service." This includes:

- Retainers: $5k-$30k/month to keep an audit firm on call for "hotfixes" or minor upgrades.

- Continuous Monitoring: Services that act as an "on-chain firewall" (detecting flash loan attacks in the mempool) cost between $2,000 and $10,000 per month.

- Bug Bounties: If you aren't prepared to pay a white-hat hacker 10% of the "funds at risk" (often capped at $1M+), you are essentially inviting black-hats to take it all.

How to actually lower your quote

Auditors charge for the time it takes to understand your code. You can reduce that time-and the price-by doing three things before the first call:

- Clean Documentation: If an auditor has to reverse-engineer your intent, you are paying $500/hour for them to read your mind.

- Invariant Testing: Show them your Foundry/Medusa tests. If you’ve already proven your invariants under fuzzing, the auditor can focus on higher-level architectural flaws.

- The Hybrid Approach: Use a "Tier 2" firm for the initial cleanup, then run a Competitive Audit (like Sherlock or Code4rena). This gives you "hundreds of eyes" for a fixed prize pool, often resulting in better coverage for $80k than a single firm would provide for $150k.

Partner with Zealynx

At Zealynx, we know that pricing transparency is just as important as technical rigor. We provide detailed, itemized quotes so you understand exactly what you are paying for-whether it's logic density, non-EVM complexity, or regulatory compliance. Stop guessing your security budget and start planning with precision.

FAQ: Smart Contract Audit Cost & Pricing

1. How much does a smart contract audit cost in 2026?

Smart contract audit costs in 2026 range from $5,000 for simple tokens to $500,000+ for complex protocols. Average DeFi audit prices (DEXs, lending protocols) fall between $50,000–$100,000. The exact cost depends on logic complexity, codebase size, blockchain platform (Ethereum, Solana, Sui), and turnaround time. High-TVL protocols requiring formal verification typically pay $150,000–$500,000 for comprehensive security audits.

2. What is the average price for a Solidity smart contract audit?

Are you audit-ready?

Download the free Pre-Audit Readiness Checklist used by 35+ protocols preparing for their first audit.

No spam. Unsubscribe anytime.

The average Solidity audit cost is $50,000–$100,000 for standard DeFi protocols (3-6 weeks). Simple ERC-20 token audits cost $5,000–$15,000, while complex systems like cross-chain bridges or ZK-rollups range from $150,000–$500,000. Solidity audits are generally 20-30% cheaper than Rust (Solana) or Move (Aptos/Sui) audits due to larger auditor supply in the Ethereum ecosystem.

3. How much does a Solana smart contract audit cost?

Solana smart contract audits cost 20-30% more than equivalent Ethereum audits in 2026. Expect to pay $60,000–$130,000 for standard Solana DeFi protocols and $180,000+ for complex programs. The premium exists because Rust auditors with deep Solana experience are scarcer than Solidity experts. Simple Solana program audits start at $7,000–$20,000.

4. What factors determine smart contract security audit pricing?

Smart contract audit pricing is determined by: 1) Logic density (complexity per line of code), 2) Codebase size (total lines and contracts), 3) Blockchain platform (EVM vs. non-EVM premium), 4) Timeline urgency (rush fees add 30-50%), 5) Audit firm reputation (tier-1 firms charge more), 6) Regulatory requirements (compliance adds cost), and 7) Additional services (formal verification, continuous monitoring, retainers). Documentation quality and pre-audit testing can reduce final costs by 15-25%.

5. Are cheap smart contract audits worth it?

Cheap smart contract audits ($3,000–$10,000) are suitable only for simple, low-risk contracts like basic tokens or NFT minting. For DeFi protocols holding user funds, cheap audits often miss economic exploits and architectural vulnerabilities because they rely on automated tools without deep manual review. A $15,000 "cheap" audit that misses a critical bug can cost millions in exploits. For protocols with TVL >$1M, invest in tier-1 or tier-2 audit firms ($50,000+) to protect user funds and reputation.

6. How can I reduce my smart contract audit cost?

Reduce smart contract audit costs by: 1) Writing comprehensive documentation (saves auditor time at $500/hour), 2) Implementing fuzz testing and invariant tests (can lower quotes 15-25%), 3) Providing clean, well-commented code, 4) Scheduling audits 2-3 months in advance (avoid 30-50% urgency premiums), 5) Using hybrid approaches (tier-2 audit + competitive audit like Code4rena), and 6) Fixing automated tool findings (Slither, Mythril) before the audit. Proper preparation can save $20,000–$50,000 on major protocol audits.

7. What is the difference between a \$20,000 and \$100,000 smart contract audit?

A $20,000 audit typically covers simple protocols (500-1,000 lines) with standard logic, 1-2 auditors, 1-2 weeks duration, and automated tool-based analysis. A $100,000 audit includes complex DeFi protocols, 3-4 auditors, 4-6 weeks deep review, manual economic exploit analysis, architectural security design review, and often includes formal verification or continuous monitoring. The $100,000 audit finds vulnerabilities that automated tools and inexperienced auditors miss—critical for protocols managing significant TVL.

8. Do I need formal verification for my smart contract audit?

Formal verification is essential for high-risk, immutable contracts including cross-chain bridges, lending protocols with >10M TVL, and any protocol where a single bug could drain all funds. Formal verification costs \20,000–$50,000 additional but provides mathematical proof that critical invariants cannot be broken. For upgradeable contracts with lower TVL, comprehensive fuzzing and traditional auditing may suffice. If your protocol is immutable and holds substantial user funds, formal verification is a security requirement, not an option.

9. How long does a smart contract security audit take?

Smart contract audit timelines in 2026: Simple tokens: 2-5 days, Standard DeFi protocols: 3-6 weeks, Complex systems (bridges, L1s, ZK-rollups): 2-6 months. Timeline affects cost—requesting a 2-week turnaround for a protocol that normally requires 6 weeks adds a 30-50% urgency premium. Top-tier audit firms have 2-3 month waiting lists, so plan security audits early in your development roadmap to avoid rush fees and ensure launch readiness.

10. Should I use a smart contract audit firm or a competitive audit platform?

Audit firms ($50,000–$500,000) provide dedicated senior auditors, deep architectural review, compliance support, and post-audit retainers—ideal for complex protocols and institutional-grade security. Competitive platforms like Code4rena or Sherlock ($40,000–$100,000 prize pools) provide "hundreds of eyes" and often find more unique vulnerabilities for lower cost—great for well-documented, medium-complexity protocols. The optimal approach is hybrid: use a tier-2 firm for initial cleanup, then run a competitive audit for broad coverage, achieving better results than a single $150,000 firm audit.

Glossary

| Term | Definition |

|---|---|

| Formal Verification | Mathematical proof technique using symbolic logic to verify smart contract invariants cannot be violated under any conditions. |

| TVL | Total Value Locked representing the aggregate dollar value of assets deposited in a DeFi protocol at any given time. |

| Economic Exploit | Attack vector exploiting protocol economic logic and incentive mechanisms rather than traditional code vulnerabilities. |

| ZK-Rollup | Layer-2 scaling solution using zero-knowledge proofs to batch transactions off-chain while maintaining Ethereum security. |

| Security Retainer | Ongoing monthly payment arrangement keeping audit firms available for rapid response to protocol updates and security incidents. |

Are you audit-ready?

Download the free Pre-Audit Readiness Checklist used by 35+ protocols preparing for their first audit.

No spam. Unsubscribe anytime.